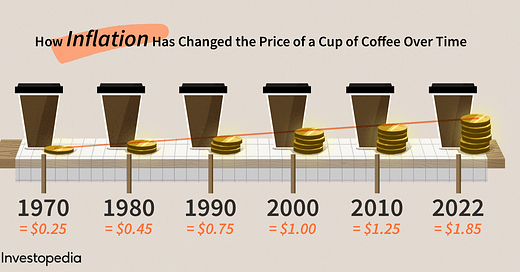

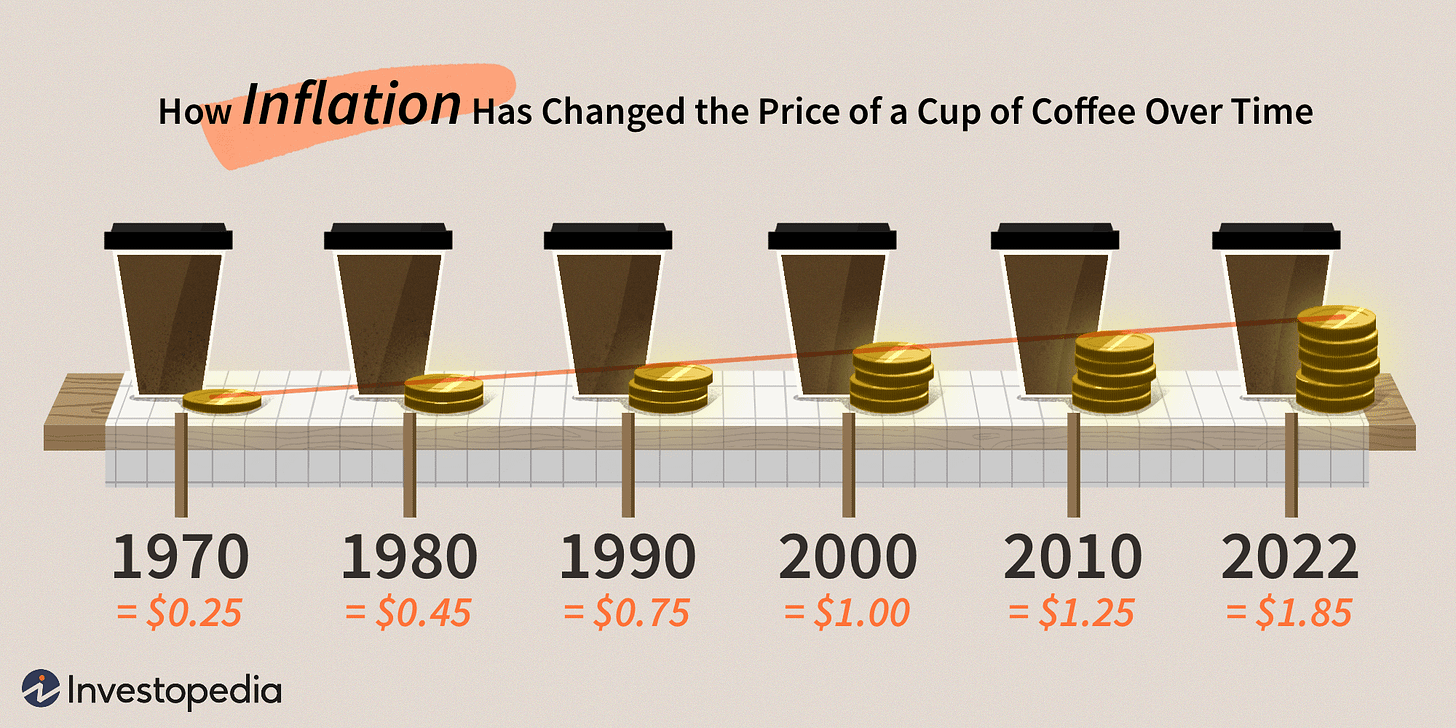

Inflation is a general decrease in purchasing power. Meaning, your money buys less or more money is required to buy the same amount.

The same size (8 oz) cup of coffee in 1970 requires more money ($1.60) to buy it in 2022. Another way to illustrate this is by keeping the price the same ($0.25) and decreasing the amount of coffee (1 oz) in the cup.

We feel inflation the most when buying commodity based goods such as groceries and gasoline. Sometimes its due to commodity shortages like with wheat or gasoline whether from war or supply chain issues.

Other times its due to too much money trying to buy the same amount of goods. Think stimulus checks.

Most of the time, like now, its a complicated mix of all of the above.

For more about inflation, check out Khan Academy’s short video explanation.

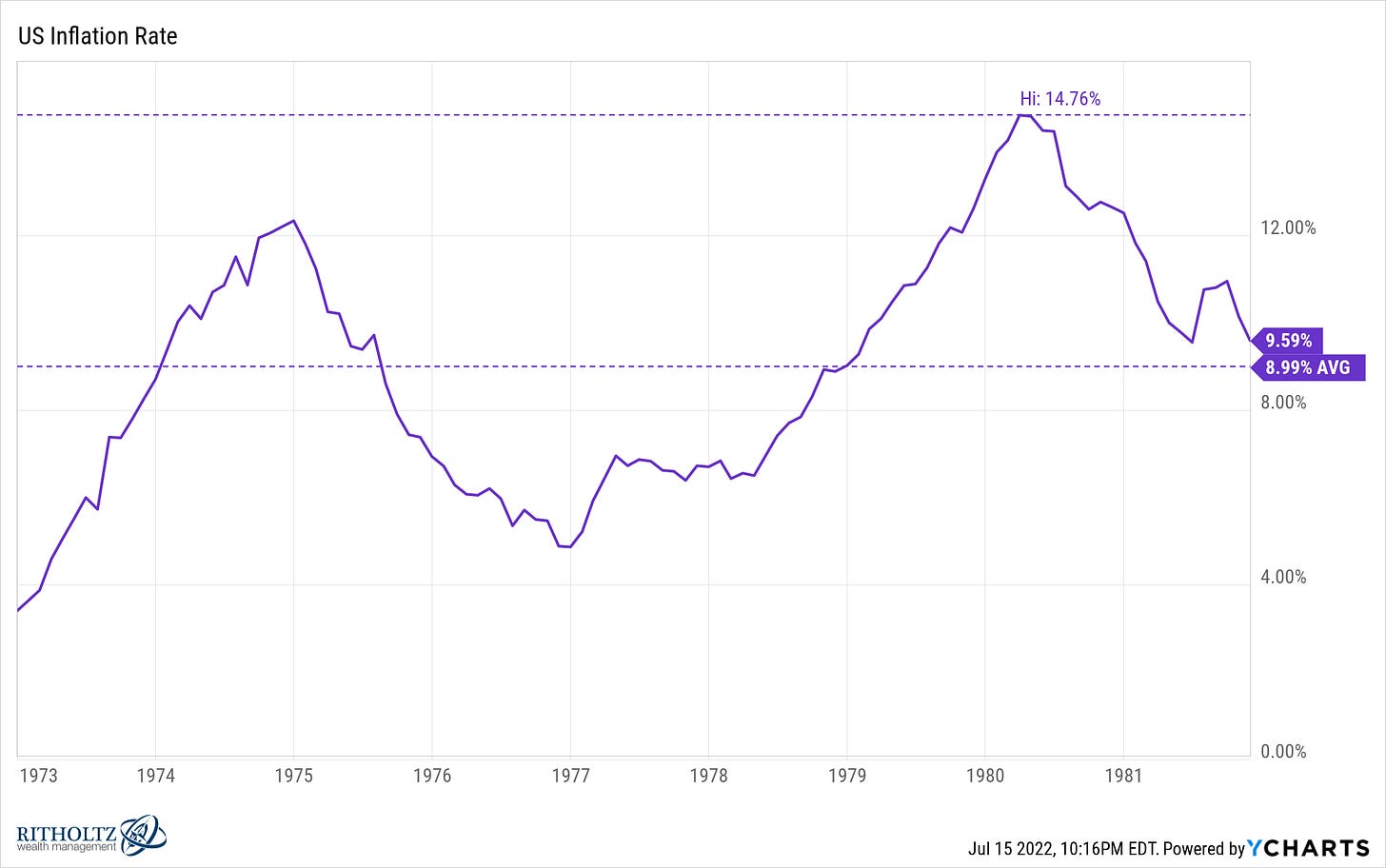

Most people can remember the last time inflation was this high back in the 1970s-1980s. Let’s compare then with now.

We are losing our minds right now over 10 months of above average inflation. How about 10 years of 9% inflation…

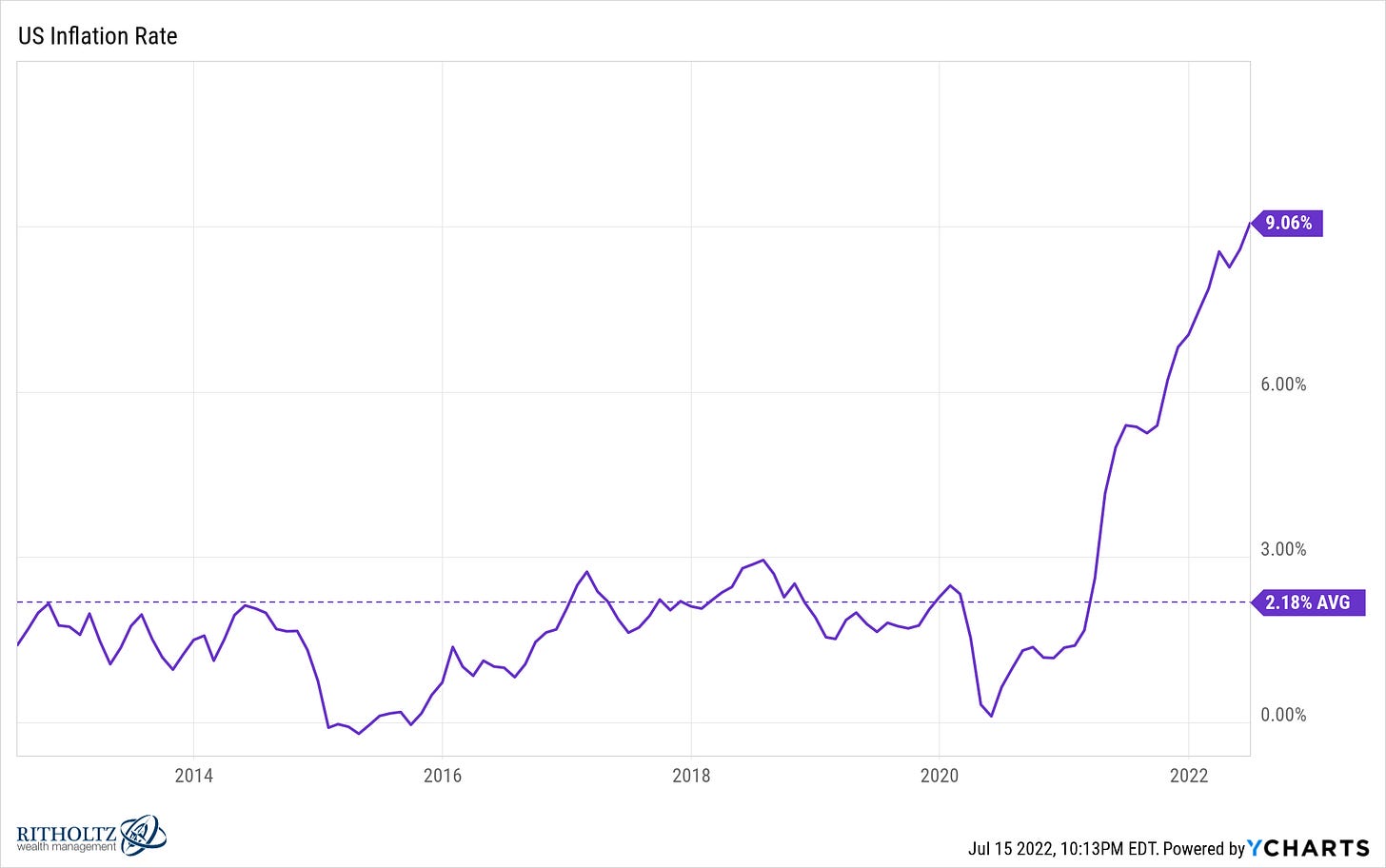

And what about now:

Inflation has been above 2% for less than a year and its all we hear on the news.

The 1970s are just laughing at us right now.

I remember my grandfather telling me stories about buying real estate with a 12% interest rate and I thought he was crazy for buying then but that was the market he had to work with and he adapted to make it work. Honestly, my generation has been sheltered from the reality of changing inflation numbers and spoiled with historically consistent and low inflation rates.

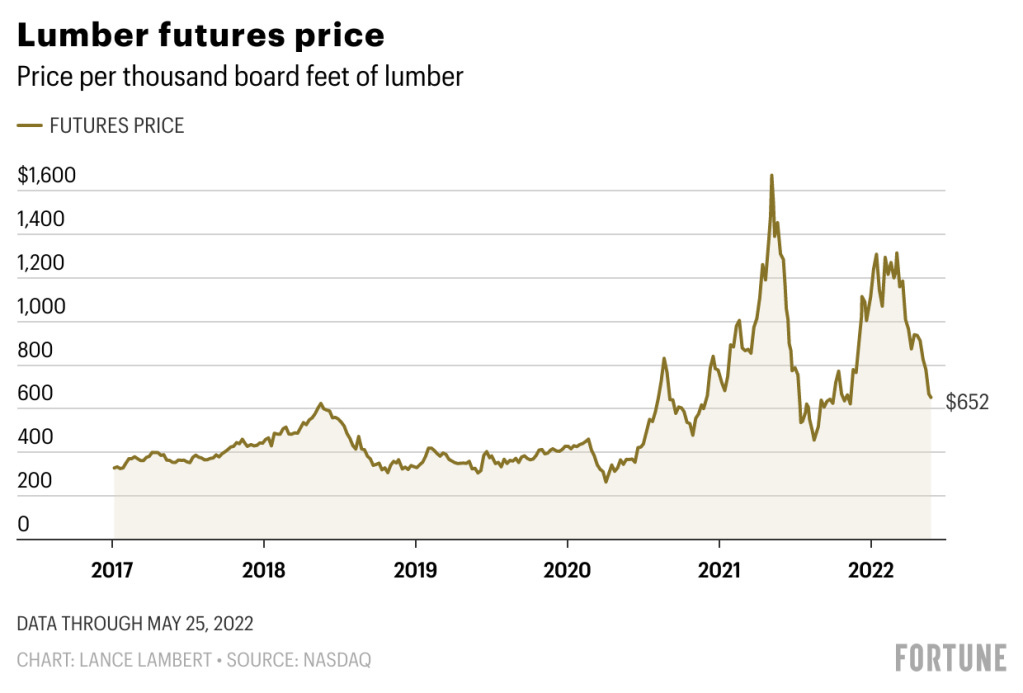

So where do we go from here? Let’s just look at a few commodity prices to check.

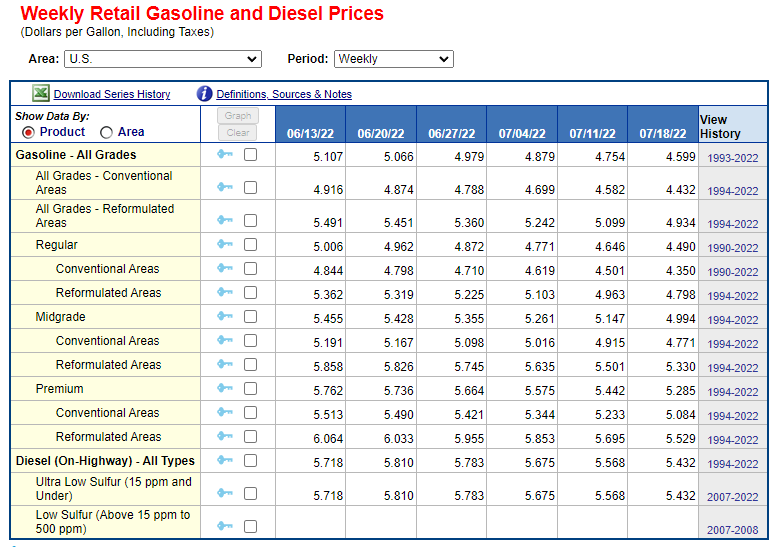

Gas prices have dropped 4 weeks in a row. Remember when some of the smart people were predicting 6-7 dollar gas in August… Here is another reminder to not listen to anyone trying to predict the future, especially the near-term future.

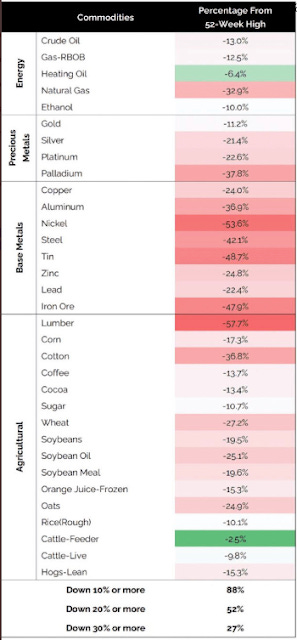

The below table may be hard to see but I like the points its trying to convey. Most measurable commodities (~80%) are down at least 10% from their 52-week highs and some like lumber (-57%) and many of the base metals and ag products are down between 25% and 57%.

What is the takeaway?

Although inflation will likely linger longer, there are several areas where its decreasing back to normal which we should see shortly in the grocery stores and at the pumps.

Lastly, a bit of economic and market commentary from Barry Ritholtz.

That is where we are today: Markets seemed to have priced in a mild recession, with peak inflation behind us. I am unsure if the markets have priced in the Fed overtightening, and I am especially concerned about earnings softening a little this quarter (Q2 reporting started last week); I am not at all sanguine about what Q3 earnings will look like.

The positives are households have cash, Corporate America’s balance sheets are great, commodity prices have fallen hard, and consumers keep spending. The negatives are sticky services inflation, especially Rent, increased credit usage, low but rising delinquencies.

The big wildcards: Will a behind-the-curve Fed overreact to inflation that is already falling? How much will the new rate regime impact Q3 earnings? Will the consensus soft landing — a silky, sexy, mild recession — morph into something much worse? Last, are weak Q3 earnings already reflected in stock prices?

Stay positive, remember your why and keep hammering on those day-to-day money best practices. We got this.