Disclaimer: Do not interpret this article as a prediction or prognostication as to the future of the banking industry. I’m not an expert in economics nor am I a fortune teller. I believe education and temperance are vital to surviving any economic turbulence.

The last 10 days have quietly been some of the worst days in banking history. Did you feel it? Most people didn’t feel it at all nor do they even know what happened or what will happen.

What you need to know is this:

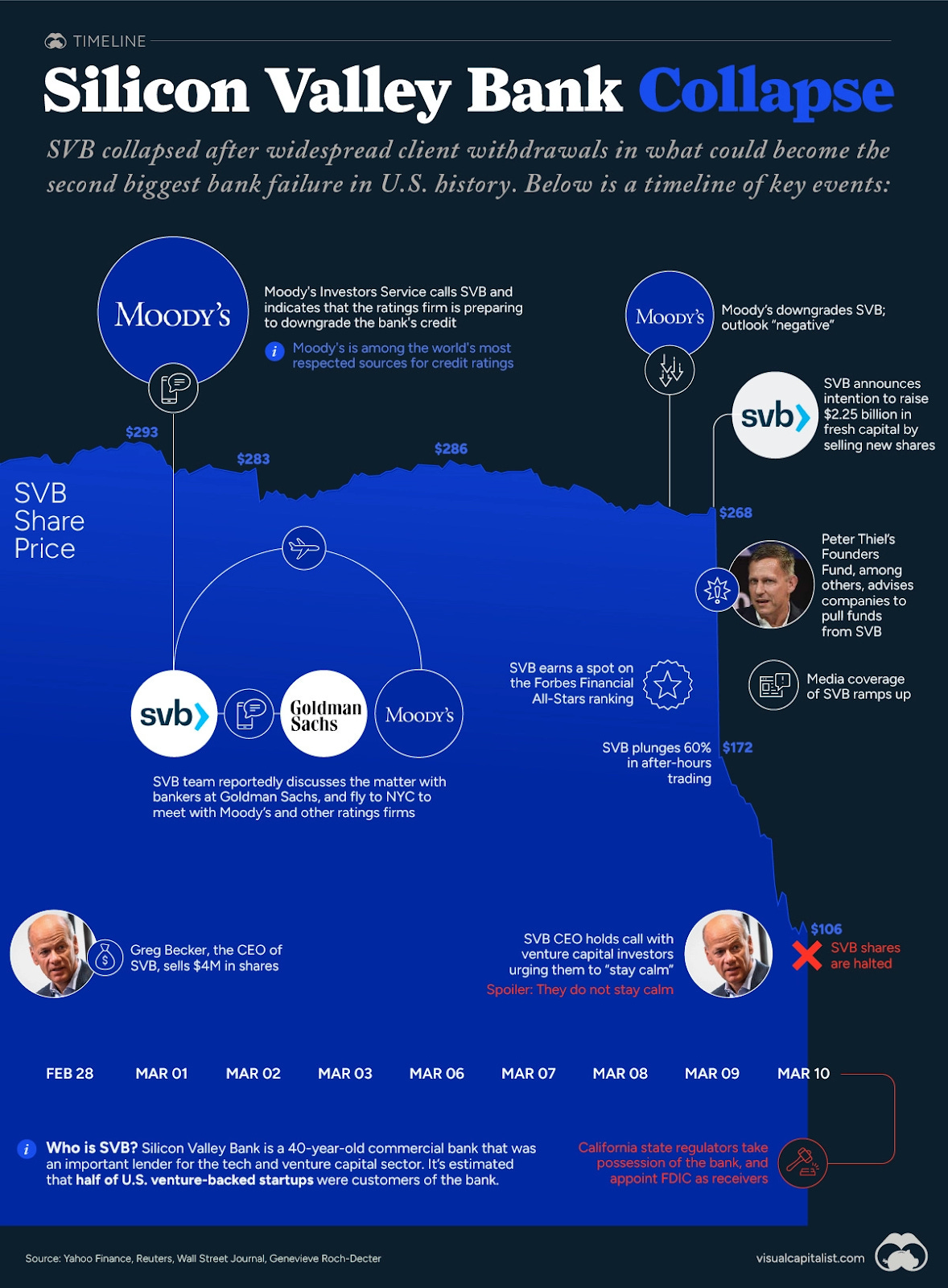

Silicon Valley Bank is the second largest bank to fail in the last 20 years.

Several other banks have failed and they most likely won’t be the last.

Once you put your money in a bank, it's not technically your money anymore.

You are responsible for your own money and you need to protect yourself.

TL/DR

Diversify Deposits

Understand deposit insurance

Monitor your bank’s health

Consider alternatives to banks

Here are the details…

Silicon Valley Bank (SVB) failed due to a combination of massive losses from buying Treasury bonds which devalued as interest rate rose and the fastest bank run in history.

To understand this we need to cover fractional reserve banking.

Dr. Fain, I hope I make you proud here.

Fractional reserve banking is a system in which banks hold only a fraction of the funds deposited by customers, and lend out the rest to earn interest. This system has been in place for centuries and is the backbone of modern banking. While it has its benefits, such as providing credit and liquidity to the economy, it also poses some risks to depositors.

If too many customers decide to withdraw their money at the same time, the bank may not have enough reserves to cover all the withdrawals, leading to a bank run.

This is what happened during the Great Depression, when banks failed en masse due to a lack of confidence in the banking system. This is also what happened to SVB but at the speed of light.

In a matter of hours on Thursday March 9th, over $40 billion dollars left SVB as large customers rushed to transfer out their money. By the next day the stock price had plummeted.

In addition, banks may invest the money they lend out in risky assets, such as subprime mortgages or junk bonds, which can lead to losses if these assets default. (2008 Financial Crisis)

This can ultimately lead to bank failures or bailouts, which can have a ripple effect on the entire economy.

In SVB’s case, it bought Treasury bonds in 2020 and 2021 when rates were near zero. And in 2023 the bank had to record the updated values of those bonds in a higher rate environment. This is ‘mark-to-market’ accounting.

The value of the bonds were slashed which annihilated SVB’s balance sheet causing a downgrade by Moodys, a stock price drop and then the aforementioned bank run.

It's like being forced to sell your house after a housing crash when your loan is higher than the sales price. AKA underwater or insolvent.

Are other banks at risk of failing?

Yes, many banks practiced similar investing strategies as SVB and will likely face similar headwinds. However, the government is working to sure up the at-risk banks.

To protect depositors, governments have created deposit insurance programs that guarantee the safety of deposits up to a certain amount. In the United States, for example, the Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor per bank.

But what if I have an account with more than $250,000 in it?

As they say in Portugal, “Boa Sorte.”

How to Protect Your Money

Diversify Your Deposits

One way to protect your money is to diversify your deposits across multiple banks. This spreads your money out, so if one bank fails, you won't lose all your money. It's also important to keep your deposits below the insurance limit set by your country's deposit insurance program.

Understand Deposit Insurance

Most countries have a deposit insurance program that insures deposits up to a certain amount per depositor per bank. Make sure you understand the insurance limit and how it works. In the United States, for example, the Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor per bank.

Monitor Your Bank's Health

Check your bank's financial health regularly. You can do this by monitoring its financial statements, credit ratings, and news reports. If your bank is showing signs of financial trouble, consider moving your money to a more stable bank.

Consider Alternative Banking Systems

Finally, consider alternative banking systems like credit unions. These may offer better interest rates and lower fees, and they may be less exposed to the risks of fractional reserve banking. However, make sure you understand the risks and benefits of these systems before opening an account.

The future of the banking system is uncertain and we don’t know when the ‘bank bleeding’ will stop but it's important to be rationally proactive right now and make sure your money is protected from avoidable risks.