We are officially in a bear market (20% drop from the highs) in most US markets averages; DOW JONES, S&P 500 and the Nasdaq.

Bear Market Averages (last 15 bear markets)

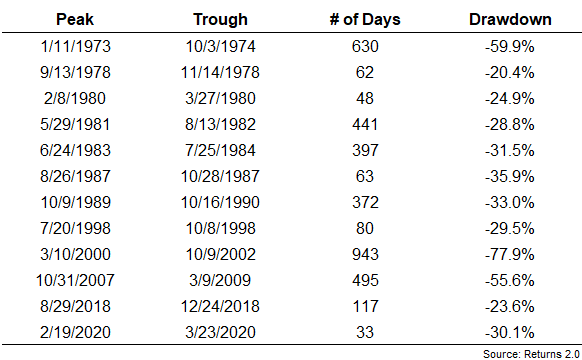

Drop from highs: 30% (Drawdown)

Time to hit bottom: 12 months (# of Days)

Time to return to high: 18 months

The Wrinkle: The last 3 bear markets were significantly shorter; 5 months, 4 months, and 6 months)

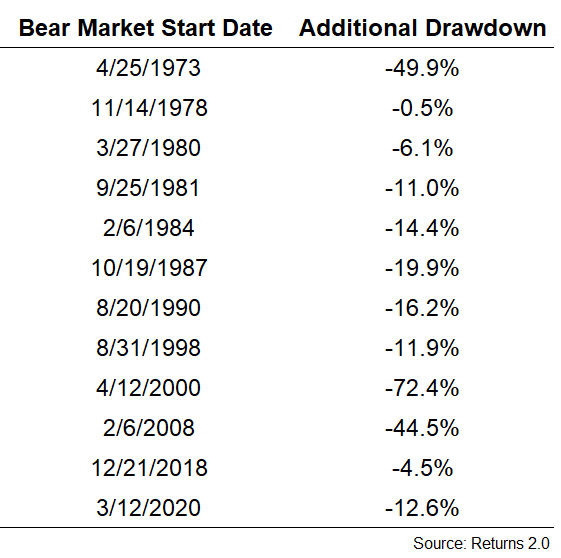

So now what? What happens after the initial 20% drop?

In short, the bleeding isn’t over. Remember that the Nasdaq is made up of all tech stocks so these numbers are higher than other less volatile indices like the SP 500 and the Dow Jones.

Allow me to hijack an old proverb,

"a bird in the hand is worth two in the bush"

It's best to buy when the market is down 20% than wait for the market to possibly drop 30% to buy.

Here's an idea; buy at both levels. That's the beauty of dollar cost averaging. You don't have to pick between the 'sales'. You can have both.

More averages:

Bear Markets happen every 7 years.

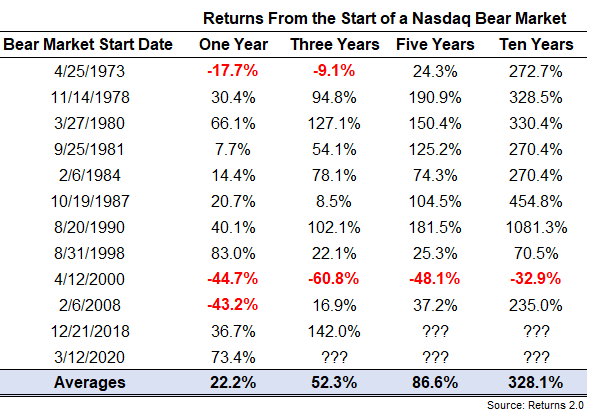

I see this as a once-in-seven-years sale. Just take a look at the returns after a bear market (in the Nasdaq). Aside from the dot-com bubble (remember that the Nasdaq is made up of all tech stocks), Most bear markets lead to above average returns.

Now who doesn’t want those returns???

This is a great time to reconsider your current allocation(% stocks vs % bonds) and possibly rebalance if you already haven't. It's also a fantastic time to put your sideline cash to work. For other action items check out my bear market playbook.

The market, and all the companies its made of, isn’t going to zero. We’ve seen this movie before; the bear (market) will die and the bull (market) will return.

Keep the faith.