Favorite Charts: April 2025

5 Charts about Consumer Sentiment, US Dollar, Housing and the Stock Market

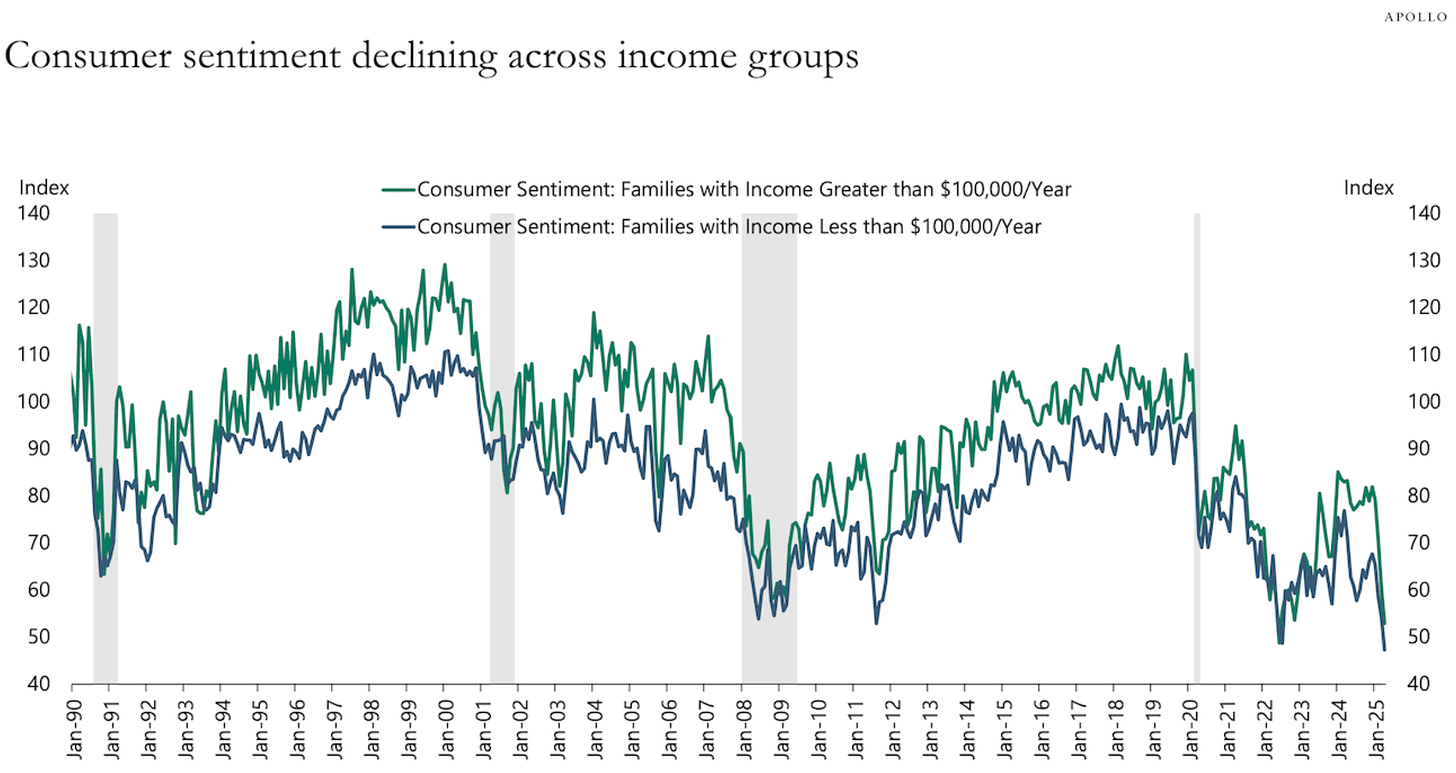

Consumer Sentiment Declines 📉

Consumer outlook has turned negative across all income groups.

Historically, sentiment was similarly low during three key periods: the Great Financial Crisis, the 2011 U.S. credit downgrade, and unexpectedly again in 2022. The upside? Markets typically saw impressive recoveries after these sentiment lows.

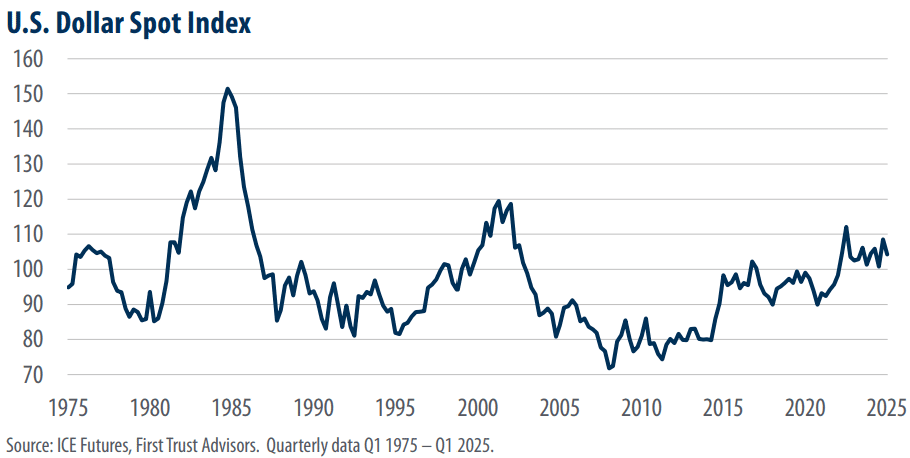

U.S. Dollar's Current Status

Tariff discussions have rattled the dollar lately, yet it remains robust compared to most periods over the last 40 years. This resilience underscores the dollar's strength.

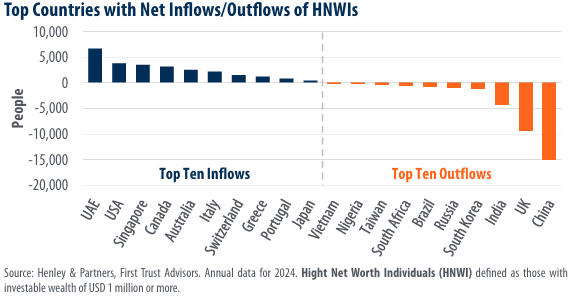

As speculation grows around replacing the dollar as the global reserve currency, high net worth individuals' actions offer insights.

Two frequently mentioned contenders are China's yuan and a collective currency from BRICS nations. First Trust poses a compelling question:

"Can a country unable to retain its top talent inspire global confidence in its currency?"

Personally, this suggests the dollar's dominance isn't seriously threatened anytime soon.

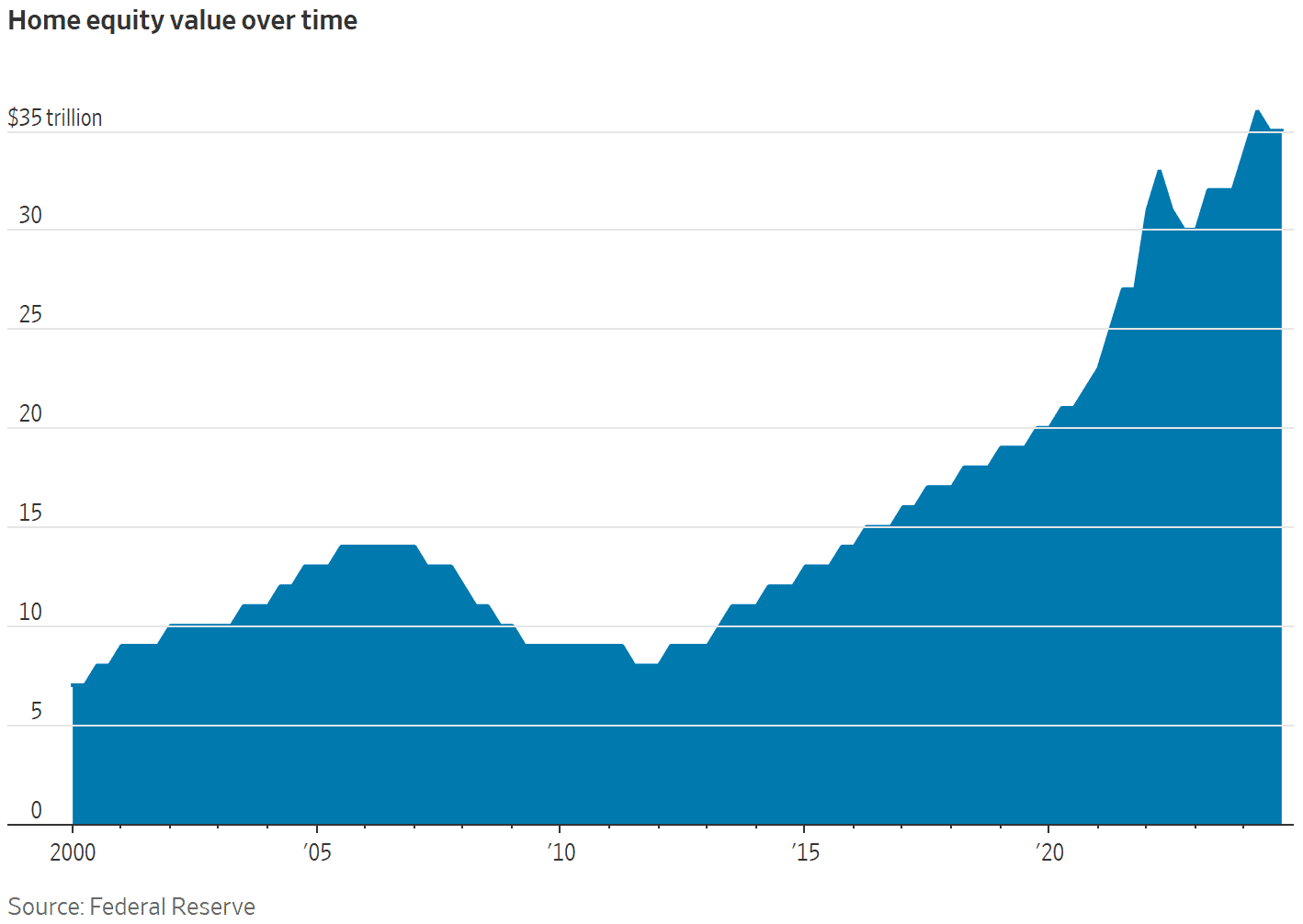

Home Equity Boom

Home equity values surged by approximately $15 trillion since 2020—remarkably surpassing the $13 trillion increase over the prior two decades combined.

Higher interest rates might make tapping into this equity more expensive, yet increased wealth undeniably provides financial flexibility for future challenges.

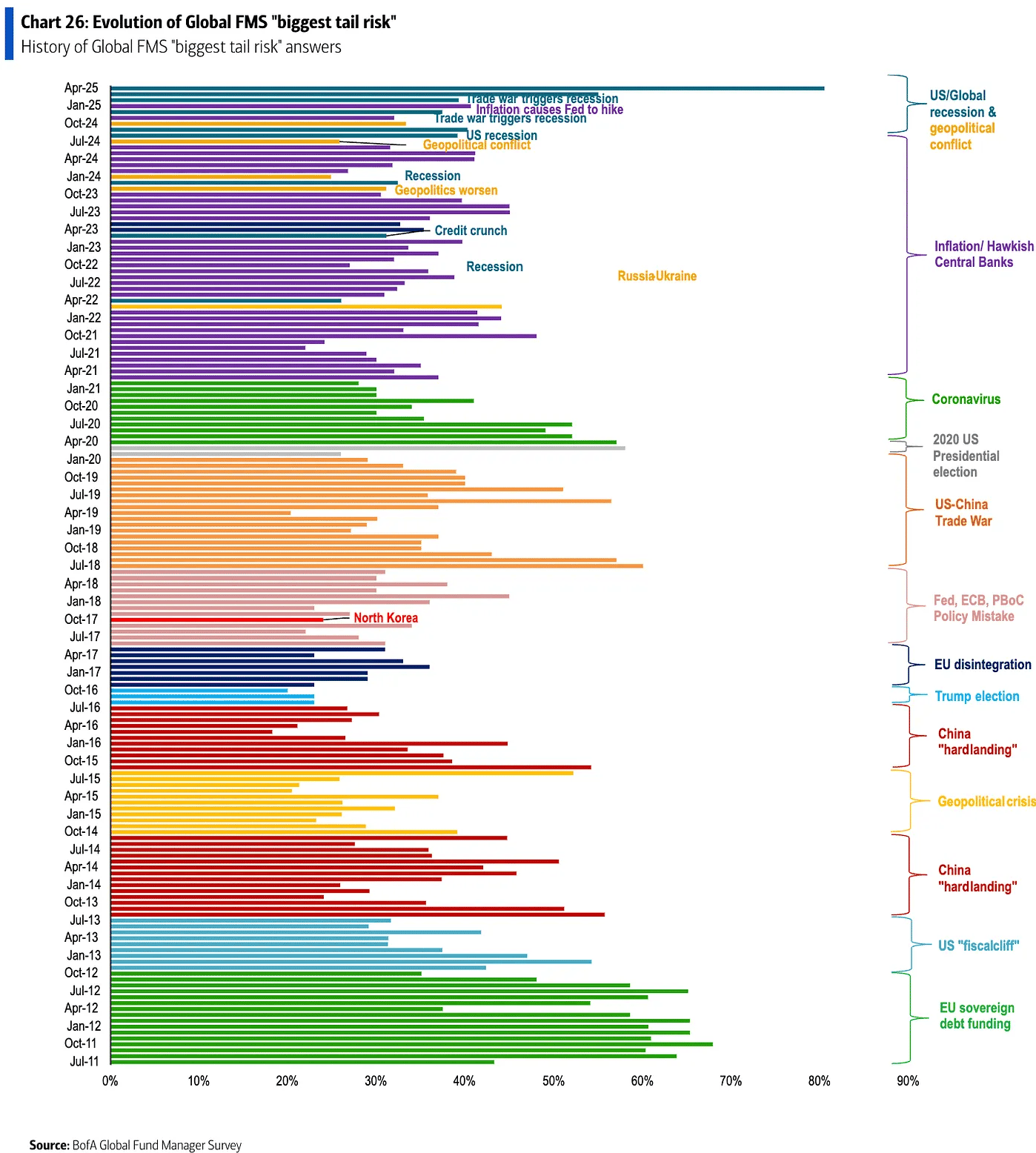

Market Risks Constantly Shift

A Bank of America chart illustrates fund managers’ "biggest market risks" each quarter for 14 years, encouraging a long-term perspective.

Today’s top concern is a recession triggered by trade conflicts. Historically, many highlighted risks never fully materialized, and even significant ones eventually faded as markets progressed.

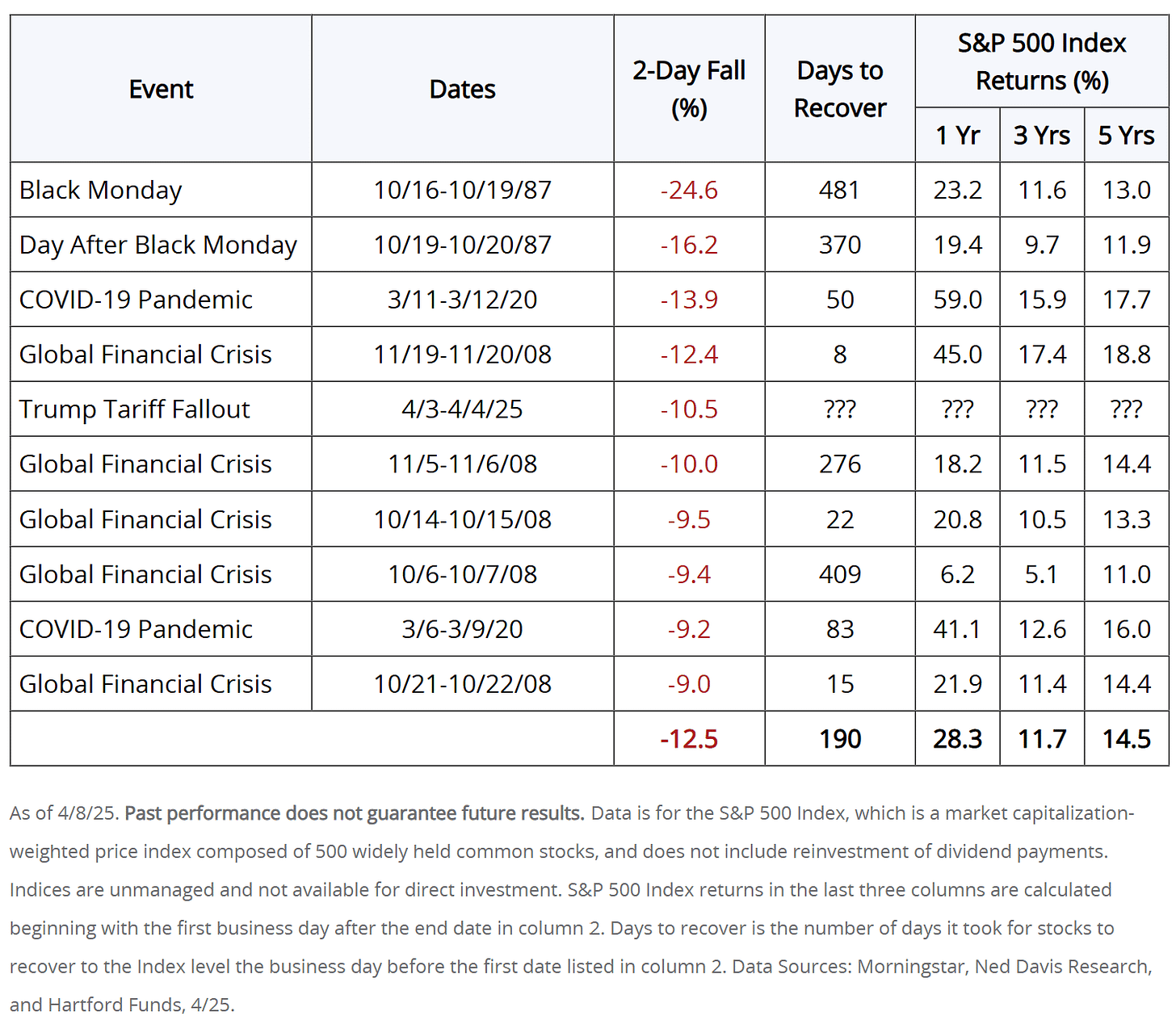

Historic Two-Day Market Drop

Earlier this month, markets fell over 10% in just two days—a significant decline. However, historically, similar sharp drops were typically followed by strong recoveries. The average market gain one year after comparable events was 28%.

Bottom Line

In discussions with clients and readers, I consistently stress patience in long-term investing.

"Patience" originates from the Latin "patientia," meaning "to endure or suffer." This perfectly captures the challenge of investing patiently.

Investing patiently isn't easy—it never was and never will be—but history clearly shows that patience pays off.

Class dismissed.