Have income over $145,000 and do the 403(b) and 457(b) catch-ups?

What the new rules are and how it affects your savings and taxes.

I had a client come in this past week asking about the changes coming to his 403(b) and 457(b) catch-up contributions. We just completed an initial plan for him and we ended up revising the plan to accommodate these new changes. The main challenge is that his working income will be much higher than his retirement income so pre-tax savings is better than Roth savings.

Ill share a summary of the new guidance and an example.

New Guidance for High-Income Earners: Catch-Up Contributions and Roth Requirements in 2025

As retirement planning evolves, recent updates to U.S. tax laws are reshaping how high-income earners can save for their golden years. The SECURE 2.0 Act, enacted in December 2022, introduced significant changes to retirement savings rules, including provisions affecting catch-up contributions for those over 50.

With fresh guidance from the IRS and Treasury Department in early 2025, these changes are coming into sharper focus—particularly for high earners.

If you’re a professional earning over $145,000 annually, here’s what you need to know about the new Roth requirements for catch-up contributions and how they might impact your retirement strategy.

What Are Catch-Up Contributions?

Catch-up contributions allow individuals aged 50 and older to contribute additional funds to their retirement accounts beyond the standard annual limits.

For 2025, the standard 401(k), 403(b) and 457(b) contribution limit is $23,500, but those eligible for catch-up contributions can add an extra $7,500, bringing their total to $31,000.

This provision has long been a valuable tool for late-career savers looking to bolster their nest eggs. Historically, these contributions could be made on a pre-tax basis (reducing taxable income now) or as Roth contributions (taxed upfront but withdrawn tax-free in retirement), depending on the plan’s offerings.

The SECURE 2.0 Shift for High Earners

Starting January 1, 2026, the rules are changing for high-income earners—defined as individuals whose prior-year wages from their employer exceed $145,000 (adjusted annually for inflation).

Under Section 603 of the SECURE 2.0 Act, if you meet this income threshold, your catch-up contributions to a 401(k), 403(b), or 457(b) plan must be made as Roth contributions.

This eliminates the option to make pre-tax catch-up contributions, meaning you’ll pay taxes on those amounts now rather than deferring them to retirement.

This shift, originally slated for 2024, was delayed by the IRS to 2026 to give employers and plan administrators time to adapt. The extra breathing room has been a relief, but with the deadline now less than a year away, it’s time to start planning.

New Guidance: What’s Been Clarified?

In January 2025, the Treasury and IRS released proposed regulations that shed light on how this mandatory Roth rule will work. Here are the key takeaways:

Income Threshold Details: The $145,000 threshold applies to wages subject to FICA (Social Security and Medicare) taxes from the employer sponsoring your retirement plan in the previous calendar year. For example, your 2025 wages will determine your eligibility for pre-tax catch-up contributions in 2026. Notably, this rule doesn’t apply to self-employed individuals or partners with no FICA wages, giving them continued flexibility to make pre-tax catch-up contributions.

Correcting Errors: If you accidentally make a pre-tax catch-up contribution when it should have been Roth, the new guidance offers a fix. Plans can perform an in-plan Roth rollover, transferring the contribution (plus any earnings) to your Roth account. You’ll owe taxes on the rolled-over amount for that year, but it keeps you compliant.

Plan Requirements: If your employer’s plan doesn’t currently offer a Roth option, high earners won’t be able to make catch-up contributions at all starting in 2026 unless the plan is updated. This puts pressure on employers to amend their plans—an action many are already taking.

A Boost for Ages 60-63: Separate from the Roth mandate, SECURE 2.0 also increases catch-up limits for those aged 60 to 63 starting in 2025. This year, they can contribute up to $10,000 (or 150% of the 2024 catch-up limit, whichever is greater), indexed for inflation. For high earners, these larger catch-ups will still need to be Roth contributions in 2026 and beyond.

Why This Matters for High Earners

For professionals in their peak earning years, losing the pre-tax option for catch-up contributions could sting. Pre-tax contributions lower your taxable income today, which is especially valuable if you’re in a high tax bracket. Switching to Roth means paying taxes upfront at your current rate—potentially 37% for top earners in 2025—rather than a possibly lower rate in retirement.

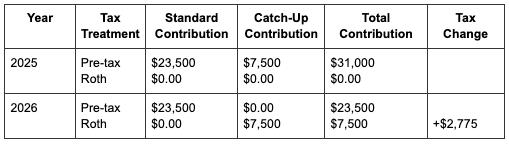

To illustrate, consider Jane, a 55-year-old engineering professor earning $175,000 annually from her employer. Below is a table showing how her 401(k) contributions might look in 2025 (before the Roth mandate) and 2026 (after it takes effect), assuming she maximizes her contributions and her plan offers both pre-tax and Roth options:

In 2025, Jane can contribute the full $31,000 pre-tax, reducing her taxable income from $175,000 to $144,000. In 2026, because her 2025 wages ($175,000) exceed the $145,000 threshold, her $7,500 catch-up must be Roth.

She’ll pay taxes on that $7,500 now (roughly $2,775 at a 37% rate), but it’ll grow tax-free for retirement. The standard $23,500 can still be pre-tax, preserving some immediate tax relief.

However, there’s a silver lining. Roth contributions grow tax-free, and withdrawals in retirement are also tax-free, assuming you meet the age and holding period requirements (age 59½ and a five-year holding period).

Plus, unlike pre-tax accounts, Roth funds aren’t subject to required minimum distributions (RMDs), giving you more control over your savings later in life.

Planning Ahead: What You Can Do Now

With 2025 already underway, high earners have a window to strategize before the Roth mandate kicks in. Here are some steps to consider:

Maximize Pre-Tax Contributions in 2025: This is your last year to make pre-tax catch-up contributions if you exceed the $145,000 threshold in 2024. If you’re over 50, contribute the full $7,500 to your 401(k) on a pre-tax basis to lower your 2025 tax bill.

Check Your Plan: Confirm whether your employer’s retirement plan offers a Roth option. If not, encourage your HR or benefits team to add it before 2026 so you don’t lose out on catch-up opportunities.

Diversify Your Savings: If you prefer Roth benefits but can’t use your 401(k) for them yet, consider a Roth IRA (if your income allows) or a backdoor Roth conversion. These strategies can complement your employer plan.

Talk to a Professional: Tax and retirement planning are highly personal. A financial advisor can help you weigh the trade-offs between paying taxes now versus later, based on your income, goals, and expected retirement tax bracket.

The Bottom Line

The new guidance on catch-up contributions reflects a broader push to balance retirement savings incentives with tax revenue needs. For high-income earners, the shift to mandatory Roth catch-ups in 2026 means rethinking how you save—and when you pay taxes. While it may feel like a loss of flexibility, it’s also a chance to build a tax-free income stream for retirement. Now’s the time to review your options and make the most of the rules still in play. Your future self will thank you.