Learn how to 3x your net worth and retire better

The Value of Financial Planning for the Goal of Financial Freedom

By Andrew White

Why earn money? Is it to use that money to save for future expenses, such as a new home, or just simply to put food on the table? Are we simply earning money for the sake of becoming “wealthy,” or are we attempting to provide for others in various ways?

These are questions that often come to mind when we are deciding which career path we want to embark on. And these are valid questions that help us decide the “why” behind our money-earning endeavors.

For many, the personal relationship with money can be quite negative or positive, depending on a variety of factors, such as how one was raised. When people grow up surrounded with money, they can often take for granted its abundance, leading to frivolous spending habits.

On the other hand, people who grow up with money can often appreciate the value of the dollar, leading a life that is marked with frugality. For those that grow up with little amounts of money, they often either covet such funds, as they were never readily available, or they develop spending habits that far outreach their means, in attempts to “make up” for what they did not have.

In either case, people are given the choice of whether they want to pursue money to just cover everyday expenses, or to earn enough money and set up a sound financial plan that will allow them to enjoy their lives through the fruits of their labors.

Financial freedom is often a term utilized to describe this desire to earn enough money and build a financial portfolio that will allow for one to live comfortably, debt free, with a little extra for that rainy day.

While this sounds incomprehensible to many, as this idea is often associated with the wealthy in society, it is within reason for almost anyone who is willing to plan out their financial future, keeping in mind the “why” behind their efforts. That is the key to this operation, setting up a sound financial plan.

In a recent study conducted by Achieve, a digital personal finance company, only 11% of Americans feel they are living their definition of financial freedom, which includes being debt-free, living comfortably, and meeting monthly financial obligations without problems. Why is this so low?

One reason may be that only 53% of Americans have worked with a financial planner, according to a recent poll conducted by the CFP Board. That leaves almost half of the country not utilizing professional planning tools for their needs.

This isn’t to say that everyone should drop what they’re doing and run to the nearest financial advisor to help them. You should find the right advisor, preferably a fiduciary (one who is legally obligated to put the client’s needs before their own), who is going to work with you to achieve your financial goal of freedom. This does however raise an interesting question of why a good portion of Americans are not being consulted by financial advisors.

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” Abraham Lincoln

Is it general lack of trust, or overconfidence when dealing with their own finances? In either case, most people do not have the time or energy to commit to setting up and monitoring their own financial plan. When they do, people may not be focussing their energies in the right areas of their finances. And they shouldn’t have to, as they are busy working diligently to earn money for themselves and their families.

While it would be great to outline every way in which one could construct their financial plan to mirror their goal of financial freedom in the future, it would take quite a good bit of time.

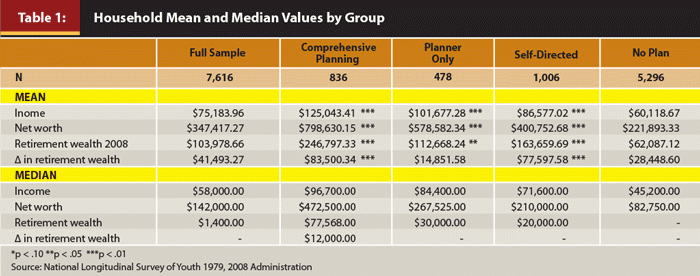

Rather than create such an outline, it would benefit one to examine the results of a study conducted by the administration of the National Longitudinal Survey of Youth (NLSY79), which sampled almost 13,000 people from 1979 to 2008.

The findings of this survey showed that when compared with people who had no financial plans, having on average a net worth of $221,893, those who utilized comprehensive planning services reported having an average net worth of $798,630.

Even those who had self-directed plans only averaged $400,753. Such funds add up, and can often be the difference between living paycheck to paycheck for the next several decades, and experiencing financial freedom, even earlier than you imagined.

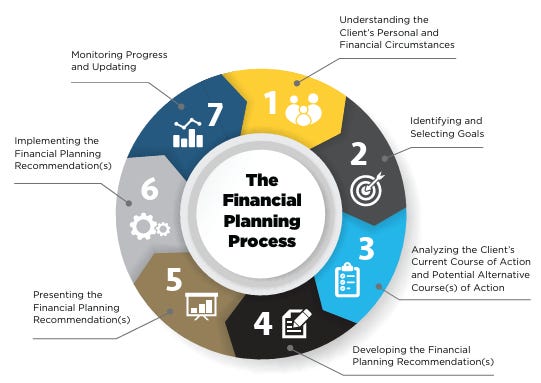

When establishing a client relationship, investment advisor representatives will utilize a researched CFP framework which guides how we work with potential clients.

Here are the 7 steps to building a financial plan.

Understanding the Client’s Personal and Financial Circumstances

Identifying and Selecting Goals

Analyzing the Client’s Current Course of Action and Potential Alternative Course(s) of Action

Developing the Financial Planning Recommendation(s)

Presenting the Financial Planning Recommendation(s)

Implementing the Financial Planning Recommendation(s)

Monitoring Progress and Updating

Source: CFP Guide to Financial Planning

For those who wish to supplement their financial planning journey with financial literature, we recommend checking out well-respected works such as The Simple Plan to Wealth by JL Collins, Simple Wealth, Inevitable Wealth by Nick Murray, or The Retirement Planning Guidebook by Wade Pfau.

These are just a few steps that will help guide anyone to better understanding their financial future, and what steps they can take to achieve financial freedom as soon as possible.