Market Review - April 2025

I’ve written this article now for the third time in as many days because the markets haven’t settled down enough to make sense of it.

As I write this on April 9th in the afternoon, the US markets have rebounded and gained back the losses from the past couple of days. In fact today was the 9th largest gain in a single day.

What crazy times we live in?! I’ve tossed around several analogies to perfectly capture the essence of the stock market and I’m stumped. If you have any good ideas please share them with me.

The markets are like a cockroach… its really hard to exterminate. Right when you think its really been smashed, it flips back over and walks off like nothing happened.

Bad, I know.

One thing I wish would change in financial media and reporting is the use of the word “loss”.

Loss has more of a destroyed connotation than misplaced or temporarily absent. When it comes to money and investing, I feel like most people interpret “loss” as destroyed. For example when someone’s account ‘loses’ $50,000 I truly believe that someone thinks that $50,000 burned in the market dumpster out back. Or $50,000 is gone forever.

The reality is the value of your company ownership is less. You still own that same amount of shares as before but now it's worth less.

If you held onto your investments through today, then your account will have ‘found’ the money it recently ‘lost’.

Why are the shares worth less? Investors start selling shares and anytime there are more sellers than buyers, the price drops.

So where does all the money go once the shares are sold?

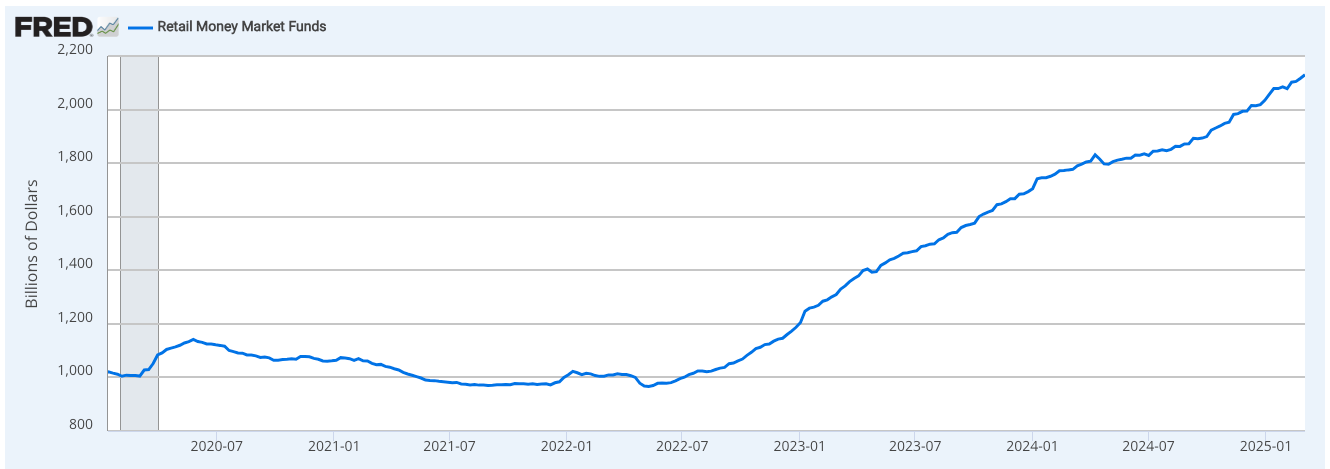

Cash or money market account. Partly due to interest rates rising, money market funds have steadily increased for years. When someone can earn 4-5% with little to no risk, money market funds seem very attractive.

Bonds are often thought to be ‘safer’ or less risky than equities and in times of volatility.

Alternatives investments like real estate, gold other commodities are sometimes seen as a hedge or mitigating investment in turbulent times.

Keep in mind that the amount of cash sitting on the sidelines that will eventually be invested back into the markets. Once interest rates come down a bit more, cash will need to find a higher returning investment. Stocks and bonds will eat up a lion's share of the cash which will drive stock and bond prices up. Remember if there are more buyers than sellers of a stock, prices rise.

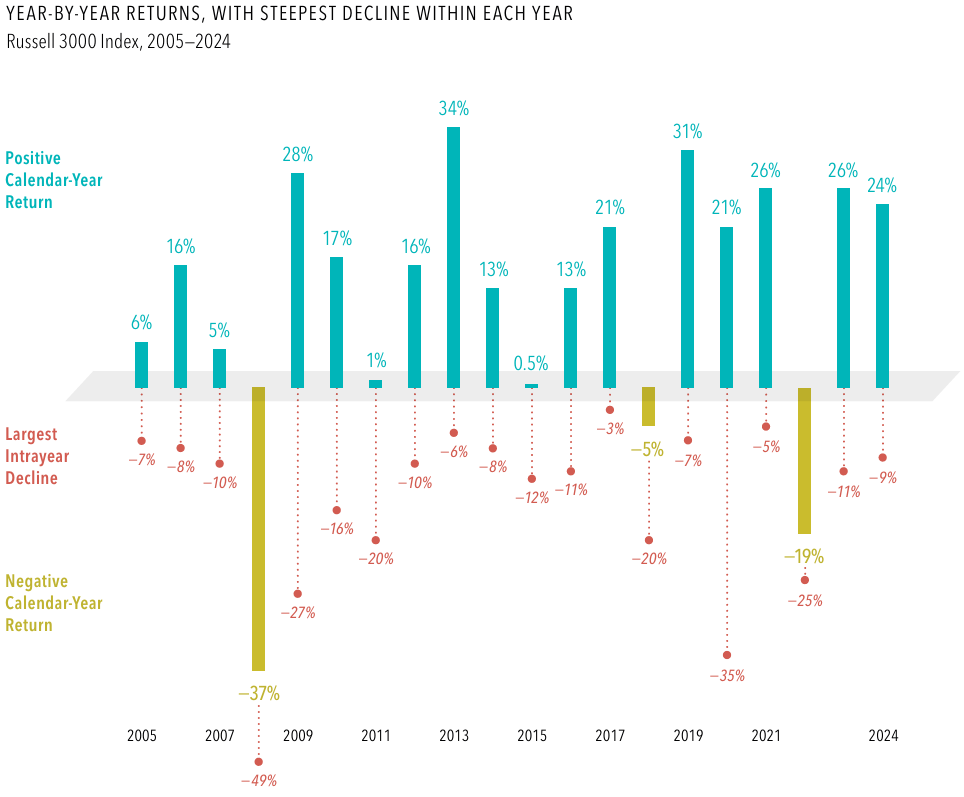

A major bit of information we often miss is how the markets end for the year after a large decline.

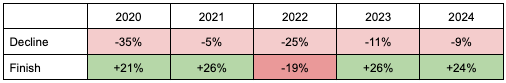

In the chart below, you will see that every year has a decline and most years end up positive. Sometimes extremely positive.

Here is a table of the past 5 years in the US markets, the largest calendar-year decline as well as the same calendar year finish.

This reminds me of a phrase I’ve hammered into my kids brains;

Just because you are losing, it doesn’t mean you have lost.

Just because your account went down, doesn’t mean it will stay down.

And as a redundant but critical reminder; worrying helps nothing.

Focus on your next best decision that you can control. Shut down the doomtube (TV/internet), call family, walk with a friend, pet your animals.

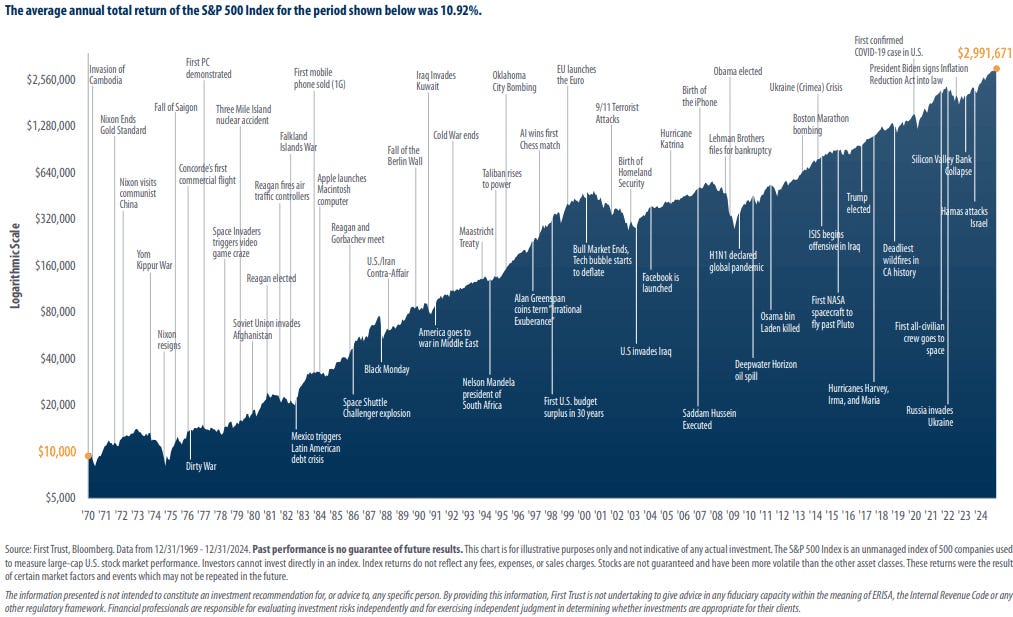

This too shall pass. As has every other major event in modern market history.