Disclaimer: I don’t work for OSU nor am I professionally affiliated with the university. Below are my opinions and shouldn’t be considered advice. Please consult with your benefits advisor for advice pertaining to your specific situation.

OSU employees recently received an email summarizing the changes to the university benefit package in preparation for open enrollment which October 28 - November 8, 2024. Here is the link to the HR page outlining the changes.

Since most employees aren’t experts on employee benefits or don’t have the time to dissect all the changes, I will provide analysis below.

I review:

Health Insurance

HSA

FSA

Roth 457(b)

Short-term Disability

Life Insurance

MASA Ambulance

Health Insurance

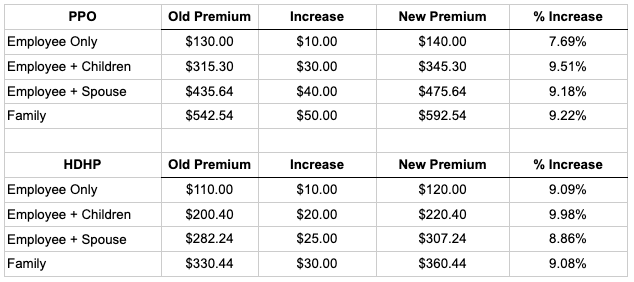

My first observation is that the increase in premiums aren’t properly labeled. The increase in medical premiums are monthly increases. The annual increase for a family PPO is $600 up to a total annual premium of $7,110.48.

As you can see, every option is getting an increase although not proportionally.

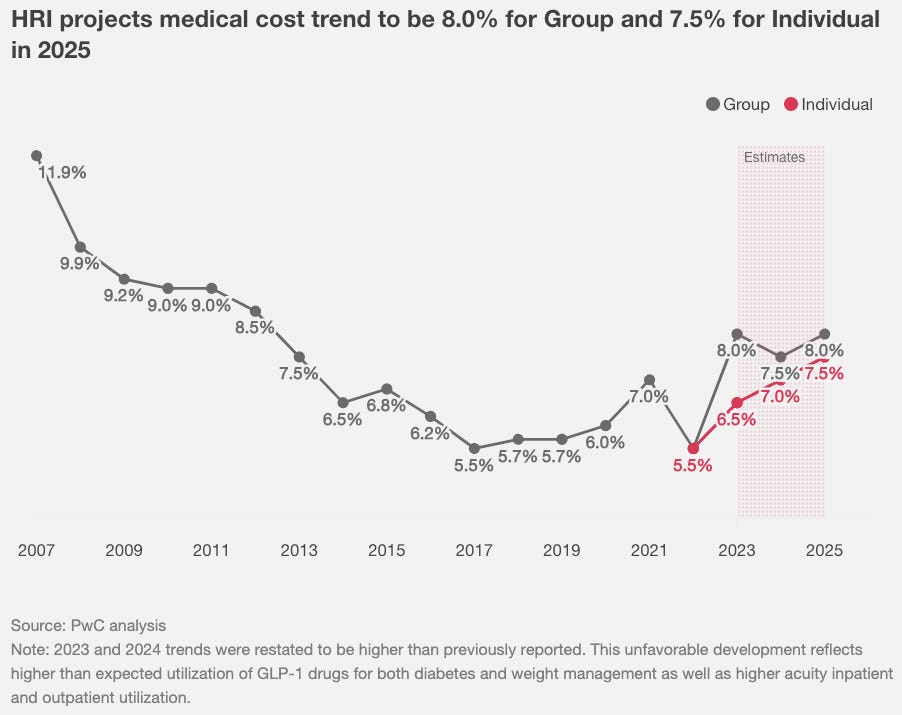

When compared to a recent PwC report, these increases exceed the projected cost increase for health care for 2025 but they are close. We have to factor in insurance admin costs on top of the true health care cost.

If you and your spouse both work for OSU and don’t have kids, the best practice is to each enroll in your own plan rather than selecting the ‘Employee + Spouse’ plan. You and your spouse will save around $195 per month on the PPO plan and $67 per month on the HDHP.

HSA

The Health Savings Account (HSA) is still one of my favorite accounts. Your money goes in tax free, grows tax free and comes out tax free when spent on healthcare expenses. This account is the most tax efficient account available. (Except for a Minor’s Roth IRA.)

If you are enrolled in the HDHP and pay out of pocket for any medical expenses, you should open up an HSA. The contribution limit for 2025 increases to $3,550 for an individual and $7,300 as a family. OSU contributes to it as well which is FREE MONEY.

FSA

I’m not a big fan of FSA because the balance can’t be carried over to next year. However, if you have a consistent medical expense like a medication or child care expense, you could open up an FSA and put just enough money to pay for that expense. I’m good with that.

Roth 457(b)

The other big change coming in 2025 is the Roth 457(b) voluntary retirement plan option. The main difference between a 403(b) and a 457(b) is the 10% early withdrawal fee. If you move on from OSU and are no longer employed, you can take money out of your 457(b) without paying the 10% early withdrawal fees. You will, however, have to pay income tax on the amount you take out.

Although these two accounts are very similar, the financial flexibility of the 457(b) makes it a better choice than the 403(b).

Now that you have a Roth 457(b) option, your potential financial flexibility just improved. Not only will you be exempt from the early withdrawal penalty, but you will also not have to pay the income tax on the amount you withdraw.

I rank the new Roth 457(b) the second best account option at OSU after the HSA.

If your situation allows, you could max out a Roth 457(b) at $23,500 per year and max out a Roth IRA at $7,000 for a total annual Roth savings of $30,500. If your spouse works for OSU too, that number can double to $61,000. Now that is massive progress!

Check out my previous post about Savings Waterfalls to learn more about saving strategies.

One last note on 457(b) and all other retirement plans including the HSA. Please make sure you review the investments inside these accounts. I’ve seen too many people contribute to these accounts and never invest the money inside them. Your money won’t grow just because it's in your 457(b).

Short-Term Disability Benefit

Short-Term Disability Benefit is not for everyone. In my opinion, you should pay for this coverage if you are the sole income earner in your household, your spouse wouldn’t be able to go to work, you have young children and you can’t depend on family to help you in case of an emergency. If this doesn’t apply to you then you would be better off ‘self-insuring’ by building up a solid foundation of savings.

Life insurance

Life insurance is also not for everyone. It should be seen as income replacement during your dependents minor years. Once your kids reach the age of majority (18) your legal obligation ends. Typically I recommend calculating the number of years your youngest child has left until 18 and multiplying that number by your annual income. Ex if your youngest kid is 8. 10 years x $50,000 annual salary = $500,000 in minimum life term insurance coverage. If your spouse works, then you could get by with less.

MASA Ambulance

MASA Ambulance coverage is a bit tricky. The odds of riding in an ambulance is low for a single individual however if your household has 3 - 6 people in it, the odds jump substantially. The coverage includes all dependents up to age 26. At $14.00 per month this might not be a bad idea for a big family while the kids are at home.

I’ll share a personal example. I sustained a serious head injury at home a few years ago. My wife drove me to the emergency room in Stillwater and we found out I fractured my skull and possibly had internal bleeding. For that reason I was transported to Integris in OKC by ambulance. That one ride wasn’t covered by my insurance and I received a bill for around $2,800. BCBS paid for $2,175 and I was responsible for $625. LifeNet allowed me to pay $25 per month, interest free, until the balance was paid. I think I’d still ‘self insure’ and pay for it if I ever took another ride but I could be persuaded otherwise.

If you have any questions, insights or comments about OSU benefits, please feel free to share them with me.