The Oklahoma Teachers Retirement System (OTRS) or Teachers Retirement System (TRS) is a pension program for public education employees in the state of Oklahoma and its a common retirement option for university faculty and staff.

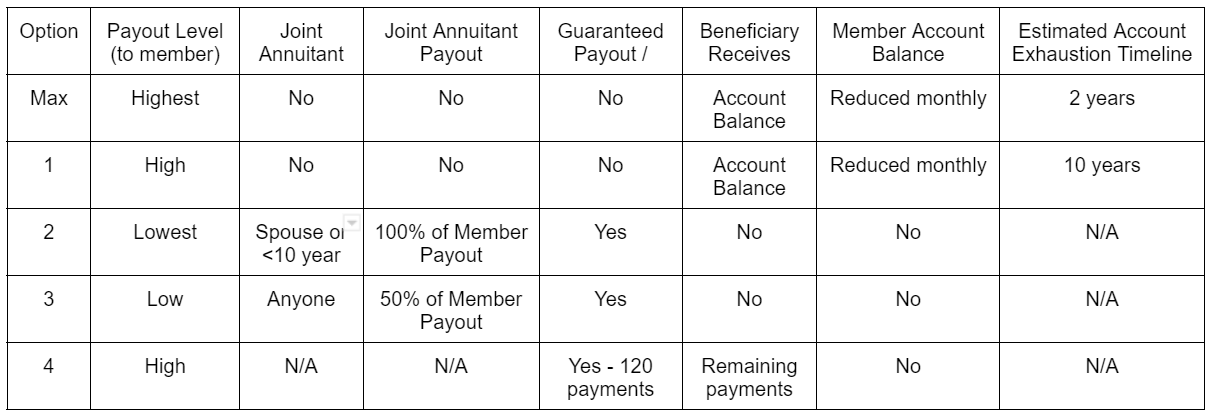

Below is a sample table of the retirement options and how each one is affected by a Partial Lump-Sum Option (PLSO).

This table does a great job illustrating how your monthly retirement ‘check’ changes with each option (1-4).

Before we cover the options lets review some key terms.

Beneficiary - the recipient of a payout benefit after the member’s death

Annuitant - the recipient of the monthly payments after the member’s death.

Maximum Option

The Maximum Option provides the largest retirement benefit, which equates to 100% of the retirement formula.

The monthly retirement benefit ceases at death, with any remaining balance paid to the beneficiary(ies).

This option could be most beneficial for individuals who want to maximize their monthly retirement income and don't have a significant concern for leaving a large balance to their beneficiaries.

For example, a retiree who is single with no dependents and has a separate, substantial estate or life insurance policy to leave to their beneficiaries might opt for the Maximum Option.

Option 1:

Lifetime Benefit For Member With Reduction

The monthly benefit under Option 1 is slightly less than the Maximum Option. Similar to the Maximum Option, the member account balance is depleted more slowly by an annuity amount. Without PLSO or EESIP, the account may last 11+ years.

The monthly retirement benefit will cease at death, and the remaining balance will be paid to the beneficiary(ies).

This plan is suitable for retirees who wish to balance their monthly retirement income with the desire to leave a larger account balance to their beneficiaries.

For instance, a retiree who has dependents but also expects to have a longer lifespan and wants to ensure that there is a significant balance left in their account for their beneficiaries might find Option 1 to be the best fit.

Option 2:

Lifetime Benefit For Member and Joint Annuitant

Option 2 or 100% joint survivorship offers the least monthly benefit for the member but the greatest benefit to the joint annuitant. The younger the annuitant, the lesser the monthly retirement benefit.

The joint annuitant, who may be the member’s spouse or someone not more than 10 years younger than the member, will continue to receive the same lifetime benefit (100% joint survivorship) upon the death of the member.

The annuitant cannot be changed after retirement, but a different person may be named to receive the $5000 survivor benefit.

This option would be ideal for retirees who want to ensure a continued income stream for a spouse or other designated joint annuitant after their death, regardless of the size of the remaining account balance.

For instance, a retiree with a younger spouse who doesn't have their own income stream or retirement plan might choose this option to ensure the spouse will continue to receive monthly income for their lifetime.

Option 3:

Lifetime Benefit For Member (50% to Surviving Joint Annuitant)

Under Option 3, the monthly benefit is not reduced as much as in Option 2. The joint annuitant does not have to be the member’s spouse or within 10 years of the member’s age.

However, the younger the annuitant, the lesser the member’s monthly benefit. The joint annuitant will continue to receive half (50%) of the monthly retirement benefit for the rest of their life upon the death of the member.

The annuitant cannot be changed after retirement, but a different person may be named to receive the $5000 survivor benefit.

This option is a good fit for retirees who want to provide some continuing income for a joint annuitant but are also interested in receiving a higher monthly benefit during their own lifetime.

For example, a retiree with a spouse who has their own retirement income might choose this option to supplement the spouse's income without significantly reducing their own monthly benefit.

If you want a child or grandchild to receive money after your death, you may consider other options that won’t reduce your monthly benefit. An example is a rollover in which your retirement benefit is moved into an IRA which allows for much more control of the withdrawal amounts and timing.

Option 4:

Lifetime Benefit For Member, Up to 10 Years for Beneficiary

Option 4 provides a monthly benefit for the member that is less than the amount under the Option 1 plan, but the beneficiary amount is usually greater.

If the member dies within 120 months(10 years) of the retirement date, the beneficiary continues to receive the member’s monthly benefit until the 120th monthly retirement benefit has been paid.

If the member lives 10 years, no balance is left for the beneficiary.

The beneficiary listed under this option may be changed at any time at the member's discretion.

This plan makes sense for retirees who want to provide a guaranteed income for their beneficiary(ies) for a set period (120 months) regardless of their own lifespan.

For instance, a retiree who has a younger, financially dependent beneficiary (like a child or grandchild) might choose this option to ensure that the beneficiary receives a monthly income for at least 10 years, providing them with financial support or time to establish their own financial stability.

I put together a simple guide covering some of the non-monetary elements of each option here:

One thing to note is that the member account balance can be depleted however, once gone, your will continue to receive monthly payments. The member account balance is mainly a benefit for the PLSO and your beneficiary.

5 options doesn’t seem like a lot but when you start digging into the details of each option and then apply your specific situation to each option, the decision making process can become overwhelming.

It's important to note that the best option will depend on a variety of factors including the retiree's financial situation, health status, life expectancy, family situation, and financial needs of their dependents.

If you have further questions, OTRS’s website is great. There are webinars, brochures, handbooks with loads of information. You can also call OTRS and ask them your questions. Or you can reach out to me (cody@stillwaterfinancialservices.com) and we can discuss which option might be best for you.

Class dismissed.