As you approach retirement, it’s easy to compare your 403(b), 401(k), or other retirement account balances to those of friends or family—and perhaps worry if yours seems smaller.

But if you have a traditional pension, you possess something incredibly valuable: a guaranteed stream of income for life. Whether you’re a professor, administrator, or staff member in higher education, understanding the true value of your pension can bring you greater confidence and peace of mind.

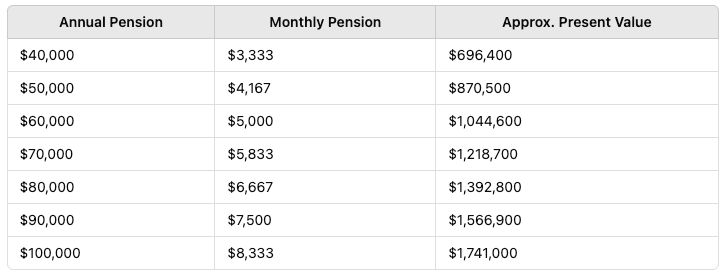

Below, we’ll explore how to estimate the “lump-sum” value of a pension and why that figure can be surprisingly large. We’ll also provide concrete examples so you can see just how meaningful your pension is to your overall financial picture.

1. What Is a Pension Really Worth?

A pension is essentially an annuity—an arrangement where you receive a regular stream of income (often monthly) for as long as you live. But since it doesn’t appear as a single account balance, people sometimes underestimate its true value.

One way to capture this value is by calculating the present value of your pension. In other words, if someone were to give you a lump sum of money right now that could reliably generate the same monthly income for the rest of your life, how large would that lump sum need to be?

Simplified Example

Annual pension payment: $36,000 (which is $3,000 per month)

Expected number of years in retirement: 25 years

Assumed annual interest (discount) rate: 3%

The present value of a series of payments (an annuity) can be estimated using a standard financial formula. A rough calculation for a 25-year horizon at a 3% discount rate shows that receiving $36,000 each year could be worth over $600,000 in today’s dollars. In other words, if you’re slated to receive $3,000 a month from your pension, that’s comparable to having more than $600,000 in a retirement account—earmarked exclusively to pay you $3,000 each month for life.

Of course, many university pension plans also have cost-of-living adjustments (COLAs) or other protections. If your pension payments rise with inflation, the “lump-sum equivalent” value can be even higher.

2. Benefits of a Pension vs. Other Retirement Accounts

Guaranteed Income for Life

Unlike a standard retirement account (like a 403(b) or 401(k)), where you need to manage withdrawals so you don’t run out of money, a pension pays you a steady, predictable monthly income until you die. This removes a major source of stress around longevity.Insulation from Market Volatility

With defined-contribution plans (e.g., 403(b), IRA), the ups and downs of the stock market can lead to unpredictable changes in your balance. A pension’s promise of a steady payout isn’t directly subject to these wild market fluctuations.No Need to “Time the Market”

If you have a pension, you don’t have to worry about selling investments at a market low just to pay your bills. Your monthly check arrives regardless of whether the market is soaring or slumping.Spousal or Survivor Benefits

Many pension plans offer options to include spousal or survivor benefits—an incredibly valuable feature that ensures your loved ones continue to receive income if something happens to you.

Let’s compare the net worths of two professors; A and B.

Professor A signed up for the Oklahoma Teachers Retirement System and saved small but consistent amounts into her 403(b). She didn’t really know how much she would have for retirement and felt underprepared for retirement.

Professor B chose the Alternative Retirement Plan (ARP) and could see her account balance grow with each month’s addition.

Below are their personal financial statements.

Because pension incomes like OTRS and social security income don’t show up on a personal financial statement, aka balance sheet, most pensioners don’t think they are worth much.

Next let’s add the net present value of OTRS and SSI to the balance sheet assuming a 3% discount rate.

Professor A, when accounting for the NPV of her pensions, is considered a pension millionaire. And she has an equal net worth as Professor B despite not having nearly as large of investment accounts.

One major caveat with pensions is the distribution election at the time of retirement. With OTRS you will have 5 different options. Each has a different payout amount and therefore a different NPV. Below is a sample from a real OTRS statement.

Options 2 and 3 are available however you must provide the joint-annuitant’s (spouse) date of birth for a projection. These will both be smaller amounts than option 1.

What Are the Five Basic Retirement Plans?

1. Maximum Option

Highest Monthly Benefit

Pays 100% of the retirement formula and generally yields the largest monthly payment to the retiree.

Effect of PLSO

If the Partial Lump Sum Option is elected, the client’s account balance is first reduced by the lump sum amount, then monthly by the gross retirement benefit.

Without a PLSO, the account balance typically depletes within 2–3 years.

Upon Death

The monthly retirement benefit ends when the client dies. Any remaining account balance is then paid to the designated beneficiary(ies).

2. Option 1

Slightly Lower Monthly Benefit

The monthly benefit is less than the Maximum Option but still close to it.

Effect of PLSO or EESIP

If the PLSO is chosen, the client account balance is reduced by the lump sum and then continues to decline more slowly based on an annuity amount.

Without PLSO or EESIP, the account balance may last 11+ years.

Upon Death

The monthly benefit ceases at the client’s death, and any remaining balance in the account goes to the beneficiary(ies).

3. Option 2 (100% Joint Survivorship for Sole Annuitant)

Least Monthly Benefit for the Client

Offers the greatest protection for the designated annuitant (beneficiary), but the client’s monthly check is reduced more than in other options.

The younger the annuitant is relative to the client, the lower the monthly benefit.

Who Can Be the Annuitant

Typically the client’s spouse or another individual no more than 10 years younger than the client (due to plan restrictions on age differences).

Survivor Benefit

Upon the client’s death, the annuitant continues to receive 100% of the monthly benefit for the rest of the annuitant’s life.

The $5,000 death benefit is still payable, and a different person (other than the annuitant) may be named to receive it.

Pop-Up Provision

If the annuitant predeceases the client, the client’s retirement benefit “pops up” (increases) to the Maximum Option.

Though the annuitant cannot be changed once designated, the client may name a new beneficiary to receive any remaining account balance and the survivor benefit.

4. Option 3 (50% Joint Survivorship for Sole Annuitant)

Moderate Reduction in Client’s Monthly Benefit

The monthly amount is reduced, but not as drastically as in Option 2.

Again, if the annuitant is much younger, the client’s benefit will be lower.

Survivor Benefit

Upon the client’s death, the annuitant receives 50% of the client’s monthly benefit for life.

A different individual may be named for the $5,000 death benefit, but the annuitant cannot be changed once chosen at retirement.

Pop-Up Provision

If the annuitant predeceases the client, the client’s benefit “pops up” to the Maximum Option.

A new beneficiary (though not a new annuitant) may be designated to receive any remaining account balance and the survivor benefit.

5. Option 4

Fixed Period (120 Months) Feature

The client’s monthly benefit is less than the Option 1 amount, but typically leaves a larger beneficiary amount if the client dies within 10 years.

Survivor Benefit Window

If the client dies before 120 months of payments have been issued, the beneficiary continues to receive the same monthly amount until the total of 120 monthly benefits has been paid.

If the client survives past 120 months, no remaining balance goes to the beneficiary.

Beneficiary Flexibility

The beneficiary for this option can be changed at any time.

What Is the Partial Lump Sum Option (PLSO)?

Clients with 30 or more years of service credit can choose to receive a portion of their retirement benefit in a lump sum at the start of retirement, plus a reduced monthly benefit thereafter.

How It Works

Clients may elect 12, 24, or 36 months of the Maximum monthly benefit as a one-time, upfront payment.

The ongoing monthly benefit is then reduced according to the client’s age and lump sum choice.

For instance, at age 62, choosing a 12-month lump sum might reduce the monthly payout to about 90%, 24 months to about 80%, or 36 months to about 70%.

Tax Considerations

The PLSO reduces the client’s account balance first, impacting what’s available for beneficiaries.

Taxes (and potentially penalties) can be significant, so clients are advised to consult with a tax professional.

Rolling over the PLSO into another qualified plan can help defer taxes.

Application and Timing

The PLSO payment is usually issued within 30 days after the client receives the first retirement check, provided all required forms are completed.

Once retired, clients cannot change their plan option or lump sum decision.

Impact on Option 1

If the client chooses Option 1 and the PLSO, the account balance may be significantly or fully depleted upon retirement. This can affect the amount left for beneficiaries.

Who Might Choose It: Retirees who need a larger amount of cash at retirement (e.g., to pay off debts or make a major purchase) and are comfortable with a lower monthly payment.

Points to Keep in Mind

Irrevocability: Once you choose a distribution option at retirement, it is typically irrevocable—you cannot change it later (except in very specific circumstances, such as the death of a spouse prior to retirement, or a later divorce and remarriage, subject to OTRS rules).

Spousal Consent: If you are married, certain options (especially those that reduce or eliminate survivor benefits) may require written spousal consent.

Age & Health: Factors such as life expectancy, spouse’s age and health, and financial needs can influence which option is most suitable.

Official Guidance: Always consult with OTRS and, if needed, a qualified financial advisor or retirement planner to see how each option might affect your long-term finances.

Like I tell my kids when they compare themselves to each other (“its not fair…”), if you are going to keep score, you better use accurate numbers.

In retirement its all about monthly income, not net worth.

Class dismissed.