Extra points for the 5x alliteration right? I’d like to thank all of my english/ literature teachers for that; specifically Mrs. Cook in 7th grade, Mr Cronin and Dr Rama Janamanchi at OSU.

Ok back to Roth IRAs

A Roth IRA is a type of individual retirement account that allows you to contribute after-tax dollars to save for retirement.

Anyone, including minors, can open a Roth IRA and contribute to it as long as they have earned income or their spouse has earned income. The annual limit is $6,500, or $7,500 is you are over 50 years old.

However, there are income limits for Roth IRAs so please check with your CPA or advisor before opening a Roth IRA.

The contributions and earnings in a Roth IRA grow tax-free, and qualified withdrawals during retirement are also tax-free.

This makes Roth IRAs particularly attractive for those who anticipate being in a higher tax bracket during retirement or who seek tax diversification in their retirement savings strategy.

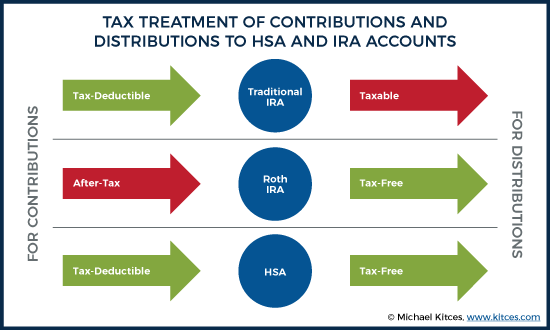

For savers, especially during the high earning years, a Traditional IRA might seem attractive due to the tax deduction one receives however, eventually you will have to pay the taxes when you start to withdraw the money.

Many people struggle with the decision to save in a Traditional IRA vs a Roth IRA. Essentially, do I pay taxes now or later? Unless you are in or close to the highest tax bracket, and you have to chose IRA or Roth, I’d recommend Roth.

The big bet is that taxes will be higher in the future and with tax rates at their lowest level in US history, and almost the lowest in the developed world, paying your taxes now isn’t a bad decision.

Better the devil you know than the devil you don't

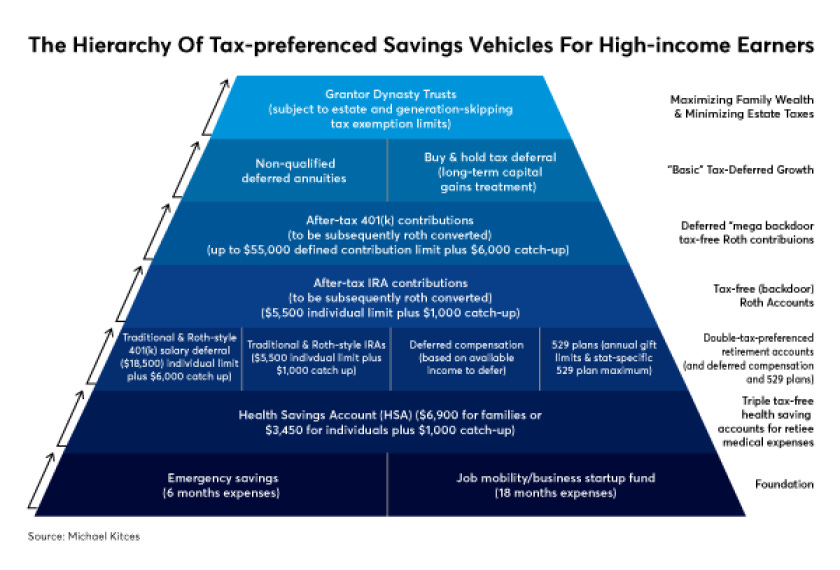

A best practice is to have savings/investments in all three buckets:

Taxable

Tax-Deferred

Tax-Free

Roth IRAs are in the '“Tax-Free” bucket.

The main idea behind having money in all three accounts, is that as tax laws change and your income needs change over the 10-40 year, you will be able to withdraw money from the most tax advantageous (lowest tax bill) account.

This financial agility is key to preserving your wealth and ensuring a long and stress-free retirement.

Most people don’t know this but in retirement, your income and therefore your taxes aren’t guaranteed to be lower than they are during your working year.

Consequently, taxes will be your biggest expense every year.

When money is pulled from qualified or tax-deferred accounts like 401ks, 403bs, 457b, IRAs, etc the money is taxed as if it was a paycheck.

Income tax rates are the highest among all sources of income.

For this reason, the Roth IRA is your best friend. Withdrawals are tax free.

This is why saving in Roth accounts is one of the first and foundational accounts when building one’s wealth as seen above.

In conclusion, Roth IRAs offer a unique and valuable retirement savings option for individuals seeking tax-free growth and withdrawals in retirement.

By allowing investors to contribute after-tax dollars and enjoy tax-free earnings, Roth IRAs provide a sense of financial security and flexibility in retirement planning.

While they may not be the ideal choice for everyone, their benefits make them an essential consideration for anyone looking to build a well-rounded retirement portfolio.

It's important to evaluate your financial situation, goals, and tax implications carefully to determine if a Roth IRA is the right fit for you.

Class dismissed…