TL/DR

A Roth conversion is a process that involves converting funds from a tax-deferred account such as a traditional IRA, 401(k) 403b, 457b, to a Roth IRA.

The main benefit of the conversion is control over future taxes from RMDs and inheritance. Especially if future tax rates are higher than current rates.

_________________________________________________________________________

The world of retirement savings can be complex, but one strategy that continues to gain popularity is the Roth IRA conversion. This process involves transferring funds from a traditional IRA or other tax-deferred retirement plan into a Roth IRA, which can offer significant long-term tax benefits. In this article, we'll cover the basics of Roth IRA conversions, including how they work, their potential advantages, and an example to help illustrate the process.

What is a Roth IRA Conversion?

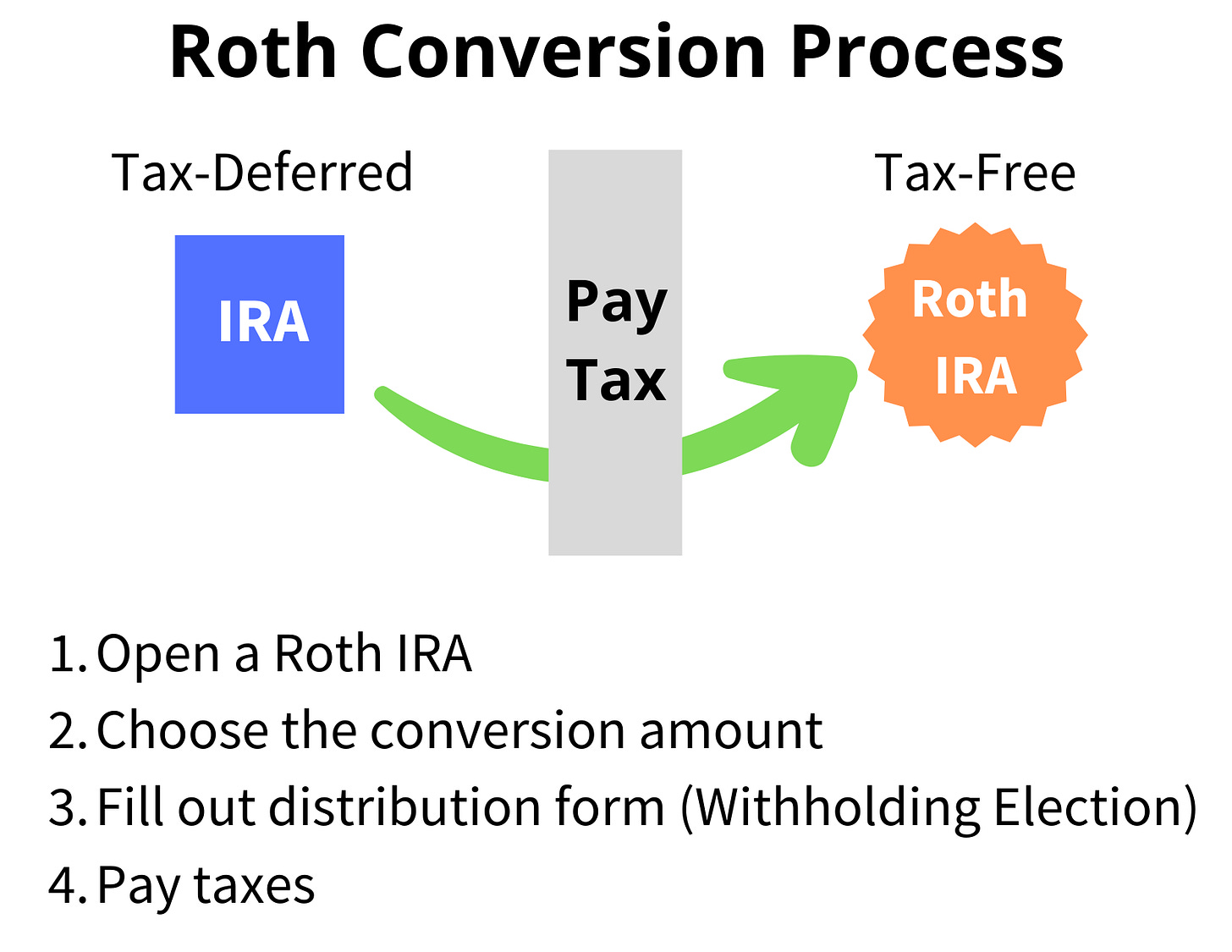

A Roth IRA conversion is a financial move that involves converting pre-tax retirement savings from a traditional IRA or a similar tax-deferred account, such as a 401(k), into a Roth IRA. By doing so, you change the tax treatment of your retirement savings, moving them from a tax-deferred environment to a tax-free one.

This can be particularly beneficial if you expect to be in a higher tax bracket during retirement, as it allows you to pay taxes on the conversion now and enjoy tax-free withdrawals later.

How to Perform a Roth IRA Conversion:

Open a Roth IRA account: If you don't already have one, you'll need to open a Roth IRA account with a brokerage or financial institution.

Choose the assets to convert: Determine which assets in your traditional IRA or tax-deferred account you want to convert. You can convert a specific dollar amount, a percentage of the account, or even specific investments.

Initiate the conversion: Contact the financial institution where your traditional IRA or tax-deferred account is held and request a Roth conversion. They will provide you with the necessary paperwork and guide you through the process.

Pay the taxes: Be prepared to pay income taxes on the amount converted, as the conversion is treated as taxable income for the year it occurs. You can pay the conversion tax in three ways:

At the time of filing, usually around April 15th

By withholding the taxes due from the conversion amount at the time of the conversion.

Send in an estimated payment around the time of the conversion to cover it.

The best practice here is to pay your taxes with after-tax dollars rather than pay via withholding. This method ensures all of your IRA dollars become Roth dollars.

Why a Roth IRA Conversion Can Be Beneficial:

Tax-free withdrawals: Roth IRAs offer tax-free withdrawals in retirement, which can be particularly advantageous if you expect to be in a higher tax bracket during retirement.

No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs have no RMDs, giving you more control over your retirement income and allowing your investments to grow tax-free for as long as you live.

Estate planning advantages: Roth IRAs can be a useful estate planning tool, as your heirs will inherit the account tax-free, potentially reducing their tax burden. Family tax bracket management often overlooked element of estate planning that could save your children hundreds of thousands of dollars.

Example:

Let's say Jane, aged 45, has a traditional IRA with a balance of $100,000, and she expects to be in a higher tax bracket during retirement. She decides to convert the entire balance to a Roth IRA. Assuming her current marginal tax rate is 24%, she would owe $24,000 in taxes for the conversion.

By paying the taxes now, Jane can enjoy tax-free growth and withdrawals on her Roth IRA in retirement. If her investments grow at an average annual rate of 7%, her Roth IRA will be worth approximately $532,899 at age 65. Assuming she meets the qualifications for tax-free withdrawals, Jane can enjoy this retirement income without worrying about taxes, providing her with greater financial flexibility and security.

Let’s expand Jane’s example to show how important it is to control income, and therefore taxes, in retirement.

As a single filer, there are 2 main income limits she needs to be aware of:

Long-term capital gains(LTCG) tax rate - $44,625

Medicare Part B Premium rates - $97,000

If Jane’s income exceeds $44,625 then all LTCG will be taxed at 15% but if, through income control, she can keep her income under $44,625, all LTCG are tax free.

Similarly, if Jane Medicare Part B Premium costs her $164.90 per month if her income is under $97,000 however if her income jumps over $97,000, her premiums will also jump to $230.80 per month for a 40% increase.

RMDs are forced withdrawals from tax-deferred accounts that are taxed at ordinary income rates (the highest). By eliminating RMDs you gain more control over your income and therefore more control over your taxes.

To calculate your RMDs, you can use this handy calculator from AARP.

Now let’s add another element to the scenario; heirs.

Jane has 3 children and all of them have good jobs. At the end of Jane’s plan she plans to give her 3 kids the remainder of her IRA account. Under current law, each kid will have to distribute the entire inherited account by the end of the 10th year following Jane’s death.

When Jane passes away at age 100, after taking RMDs for 28 years, her IRA now has a balance of $173,000. Divided 3 ways equals $57,666. Let’s assume each child’s marginal tax rate is 35%. Over $20,000 of the $57,666 inheritance will go to taxes. And all three kids incomes will be pushed up possibly causing a domino effect throughout their own tax returns.

If Jane passes on a Roth IRA, all $57,666, despite also being subject to the 10-year rule, is tax free.

In a sense, Jane, by using a Roth conversion strategy, pays the future tax bill of her kids. Which at a likely higher rate, is quite a gift. And an exclamation point on her legacy she is leaving behind.

Conclusion:

Roth IRA conversions can be a powerful tool for those looking to optimize their retirement savings strategy. By understanding the process, evaluating the potential benefits, and consulting with a financial advisor or tax professional, you can make an informed decision about whether a Roth IRA conversion is the right move for you.

Homework:

PHD level detail can be found on the Bogleheads wiki.

And another one about Why Roth conversions always pay off.