Most of what I'm going to write today comes from the 5th chapter of my favorite money book called The Psychology of Money written by Morgan Housel. Chapter 5 is entitled Getting Wealthy Vs Staying Wealthy and the subtitle is Good Investing Is Not Necessarily About Making Good Decisions. It's About Consistently Not Screwing Up.

Don’t worry, this isn’t an affiliate link. I’m not getting paid to endorse this book. I endorse it because its ‘Fire’ as the young folks would say.

Mr. Housel starts the chapter by telling the story of Jesse Livermore, who was perhaps one of the greatest stock market traders of his time and the early 1900s.

In short, Jesse Livermore shorted the market (speculated the market would drop) and in one day made more than $3,000,000,000 in today's money. After his trading success, Livermore went on to make larger and larger bets and wound up losing every dollar he had in the market. He didn’t survive financially or literally.

The author makes the point that Livermore, like several other people in history, were really good at getting wealthy and they were equally bad at staying wealthy.

Skills for Getting Wealthy

Taking risks

Being optimistic

Putting yourself out there

Skills for Staying Wealthy

Humility

Frugality

A healthy version of fear or paranoia

“If I had to summarize money success in one word it would be survival.”

-Morgan housel

As an investor, each of us should focus on activities that help us survive financially. Or put in another way, we need avoid the self-extinction money decisions that lead to our ultimate demise.

Why is survival so key to investing success?

If you still have money, you can always try again.

Think about a peach tree here. A peach tree produces 100 peaches each with a seed. If you plant all 100 seeds and each one turns into a tree. Now you have 101 trees all producing peaches and seeds. Plant those and your one peach tree turns into thousands of trees in no time. This is similar to how compounding interest works.

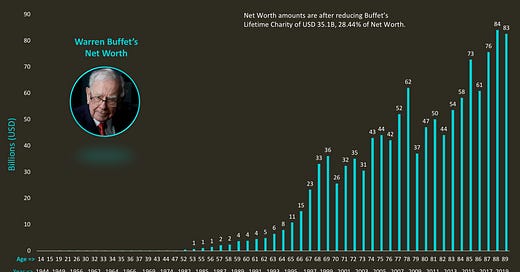

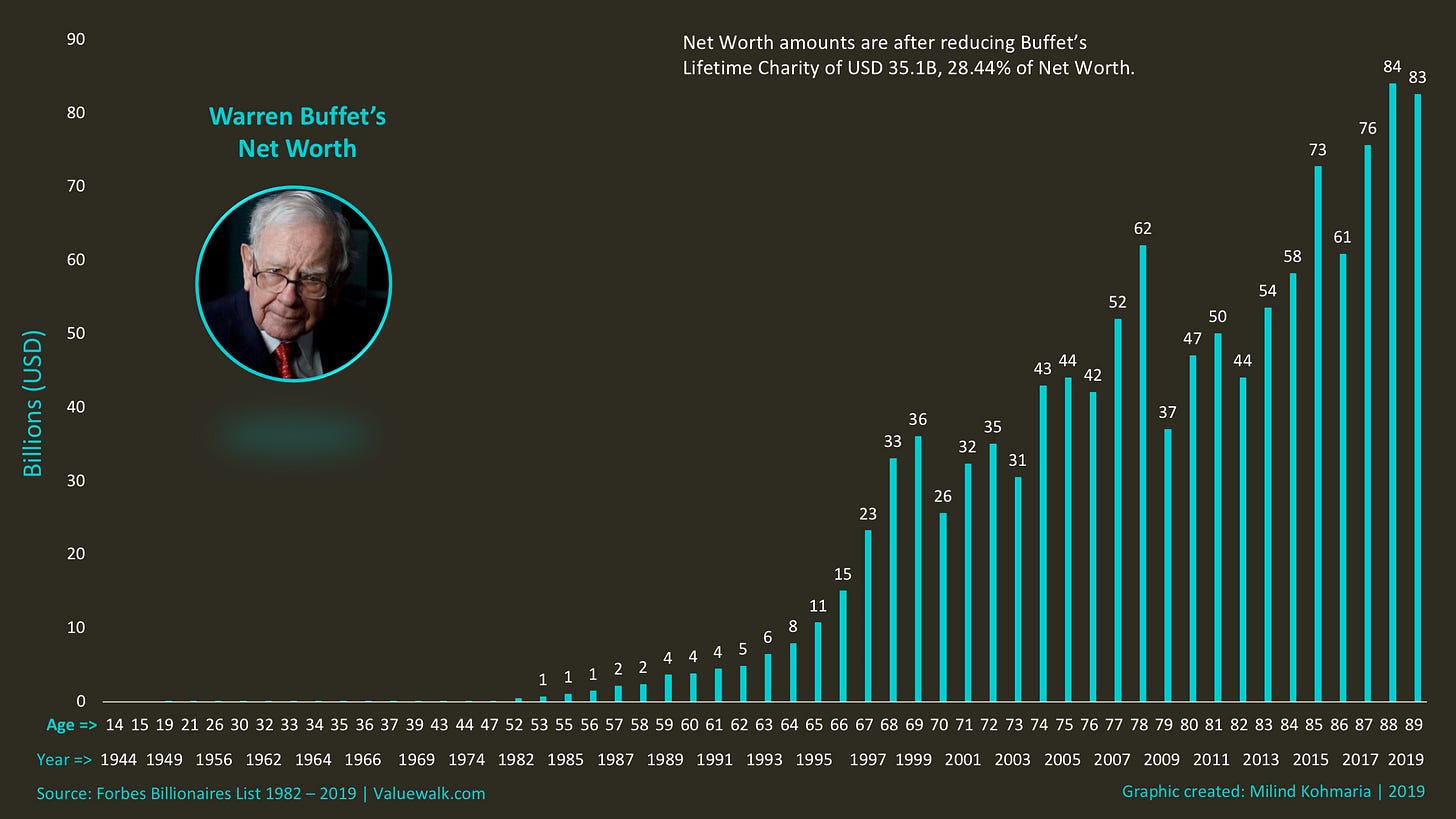

One of my favorite ideas about Warren Buffett is his wealth path. We may all think that it was linear or maybe even staircase-like. But no, its been mostly exponential.

As I write this Warren Buffett's net worth is 84.5 billion. of that, 84.2 billion was accumulated after his 50th birthday. 81.5 billion came after he qualified for social security, in his mid-60s.

Warren avoided all the trappings of investing including negative financial news media, financial crisis du jour, and even wars, and survived. His financial survival gave him longevity and longevity is fertile ground for compounding.

The first rule of investing is don’t lose money. The second rule of investing is remember the first rule.

- Warren Buffett

Warren and many others have adapted and survived for decades in our financial jungle by staying educated on investing and finances and hopefully you will too.

The same old advice stands; save your money, don’t take too much risk, don’t chase financial fads, don’t try to time the market, and survive.