TL/DR

If you withdraw 4% of a retirement account invested in 50% Stocks and 50% Bonds each year, there is a high chance (+90%) you will never run out of money.

Introduction

Retirement planning can be a complex and intimidating process, but understanding key principles like the 4% rule can help simplify your approach and ensure a secure and comfortable retirement. The 4% rule is a popular guideline that dictates how much you can safely withdraw (lots of info on the Boglehead’s website → Safe Withdraw Rate) from your retirement savings each year without running out of money.

In this article, we'll explore the history of the 4% rule, provide a real-life example of its application, and discuss some reasons why it might be too high or too low for your unique financial situation.

History of the 4% rule

The 4% rule was developed by financial advisor William Bengen in 1994, who sought to answer a common question among retirees:

"How much can I withdraw from my retirement savings without running out of money?"

By analyzing historical market data, Bengen determined that a safe withdrawal rate for a 30-year retirement period would be approximately 4% of the initial portfolio value, adjusted for inflation each year. This rule has since become an essential guideline for financial planning and retirement preparation.

Methodology

Bengen's approach to developing the 4% rule involved a deep dive into historical market data, examining how different withdrawal rates affected the longevity of retirement savings over various 30-year periods. He focused on a balanced portfolio of 50% stocks and 50% bonds, which is a common asset allocation for retirees seeking a mix of growth and stability.

By analyzing these historical trends, Bengen found that the worst-case scenario for a 30-year retirement period resulted in a 4% withdrawal rate, adjusted annually for inflation. This rate allowed retirees to maintain their desired lifestyle without the risk of depleting their savings before the end of their retirement. The 4% rule has since become a widely accepted benchmark in the world of retirement planning, providing a simple and effective framework for determining a safe withdrawal strategy.

Here is Bengen’s original paper for all the nerds out there.

Applying the 4% rule to retirement savings

To understand how the 4% rule works in practice, let's consider an example of a retiree who has accumulated $1 million in retirement savings. Following the 4% rule, the retiree would withdraw an initial amount of 4% of their portfolio, or $40,000, during the first year of retirement. This amount would then be adjusted annually for inflation, ensuring that the retiree's purchasing power remains consistent throughout their retirement years.

Scenario: Retiring with $1 million

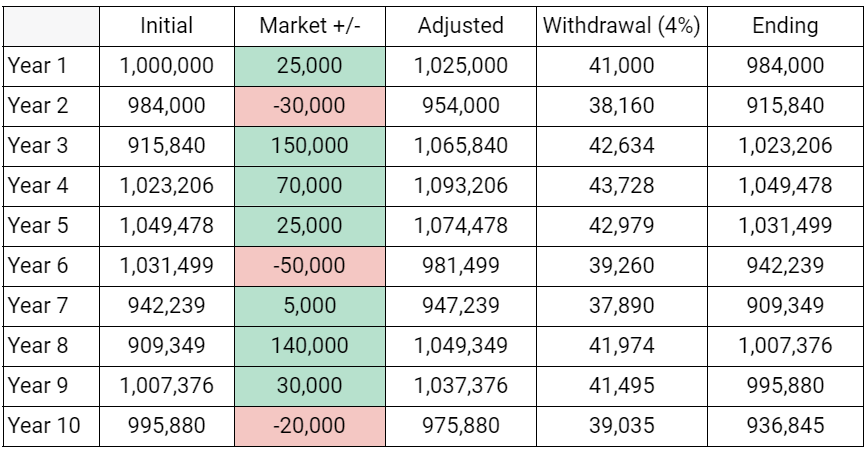

Here's a simple illustration of how the 4% rule might look over the first 10 years of retirement for an individual with $1 million in savings:

In this example, the initial withdrawal of $41,000 and by the fifth year of retirement, the retiree is withdrawing $42,979. The ending balance at the end of each year represents the remaining retirement savings after accounting for the annual withdrawal.

Over time, the account balance will go up and down but it will stay close to the initial account balance of $1,000,000,

What I like about this method is that despite being rigid in the rate, 4%, the actual dollar amounts move with the account balance creating a semi-dynamic withdrawal rate. This ensures that the retiree protects the account in a systematic and predictable manner.

By adhering to the 4% rule, the retiree in this example can maintain a relatively consistent lifestyle throughout their retirement years while minimizing the risk of depleting their savings too soon. This approach offers a straightforward method for determining a sustainable withdrawal rate, providing a sense of security and financial stability during retirement.

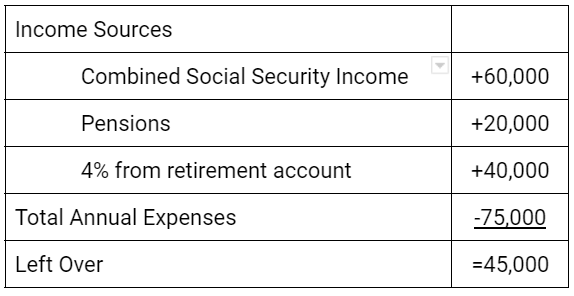

What does this look like when considering all sources of retirement income?

Typically, retirement accounts like an old 401k or IRA aren't the only source of income for most retirees. Social security income, pensions like a teachers retirement pension, provide some income. The 4% rule applies only to the account from which it is withdrawn.

What then happens when you don’t need all 4% from your account?

I advise my clients to either reduce your withdrawals or Spend More Money!

You can’t take it with you and likely your kids don’t need it, don’t want it, or in some cases shouldn’t inherit it. So…

Donate more

Travel more

Spoil your grandkids

Start a hobby, even an expensive one

Buy a newer car

Remodel your house

Etc

As mentioned in a previous article, Investing in Happiness, money can buy happiness if spent on strengthening relationships.

Reasons why the 4% rule might be too high (withdrawing too much money)

Unreliable bond yields

The 4% rule was developed based on historical market data that included relatively high bond yields. However, in today's volatile interest-rate environment, bond yields are less reliable, which can impact the overall performance of a retiree's portfolio. This means that retirees may need to consider a lower withdrawal rate to account for the reduced income from bonds, ensuring that their retirement savings last throughout their retirement years.

Longer life expectancies

Another reason the 4% rule may be too high is that life expectancies have continued to increase since the rule was first introduced. As retirees live longer, they need to ensure their retirement savings will last for a more extended period. This may necessitate a lower withdrawal rate to reduce the risk of outliving their savings.

*Sequence of returns risk*

The 4% rule does not take into account the sequence of returns risk, which refers to the impact of market performance on a retiree's portfolio during the early years of retirement. If a retiree experiences poor market returns early in their retirement, it could severely impact their ability to maintain the 4% withdrawal rate without depleting their savings too quickly.

To mitigate this risk, retirees may consider adjusting their withdrawal rates based on market performance or using other strategies such as a bucket approach or dynamic withdrawal strategies.

Check out the

Reasons why the 4% rule might be too low (withdrawing too little money)

Conservative approach to retirement planning

The 4% rule is often considered a conservative approach to retirement planning. While it aims to minimize the risk of outliving one's savings, it may also result in underutilizing retirement savings. Some retirees may prefer to balance safety with a higher quality of life, which could involve a higher withdrawal rate, especially if they have other sources of income or a shorter retirement horizon.

Portfolio diversification and risk

The 4% rule was initially based on a simple 50% stocks and 50% bonds portfolio. However, more aggressive allocations such as 60/40 or even 70/30 are common among retirees who have large fixed income sources like social security and pensions that can comfortably cover their basic living expenses.. This could potentially allow for a higher withdrawal rate without significantly increasing the likelihood of outliving their savings.

In conclusion, the 4% rule provides a helpful starting point for retirement planning, but it may not be suitable for everyone.

Factors such as current market conditions, life expectancy, and individual risk tolerance should be considered when determining an appropriate withdrawal rate for your unique financial situation.

When planning for your retirement, and specifically creating lifetime income, consider all sources of income, your risk profile and find a plan that provides the most peace of mind.