Next to cockroaches, humans might be the next best animal at surviving. We love action. It feels good. Doing nothing, especially in the face of what feels like a car crash or boat accident, feels wrong. The following are the RIGHT actions to take when the market is (temporarily) down.

Bear Market (cyclical) Playbook

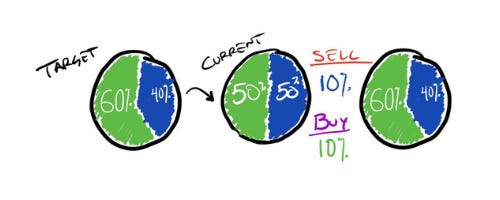

Rebalance - No doubt your portfolio is changing. Make sure it doesn’t change too far outside of your risk level by selling some bond and buying the ‘on sale’ equities to return to your proper allocation.

Tax Losses - Selling these holdings at or around your basis will allow you to offset some gains and reposition your money going forward.

Roth IRA Conversions - If you’ve planned on doing a Roth IRA conversion this year, now might be a great time to accelerate those plans.

All other contributions - This one is my favorite. For those of your savings monthly into any annually restrictive account like a 529, HSA, IRA, Roth IRA, 401(k), Donor Advised Fund, consider ‘frontloading’ your contributions now rather than spreading them out over the course of the year.

Stay the course, and here’s why.

Then there are the wrong things to do when the market is (temporarily) down. Panic is the main one, which leads to feel-good but outcome bad moves, like selling to cash and sitting. Think financial hypothermia. People do wacky things when hypothermia kicks in. Like stripping down in freezing weather because you ‘feel’ hot.

Lets explore some of the facts to reset our financial temperature:

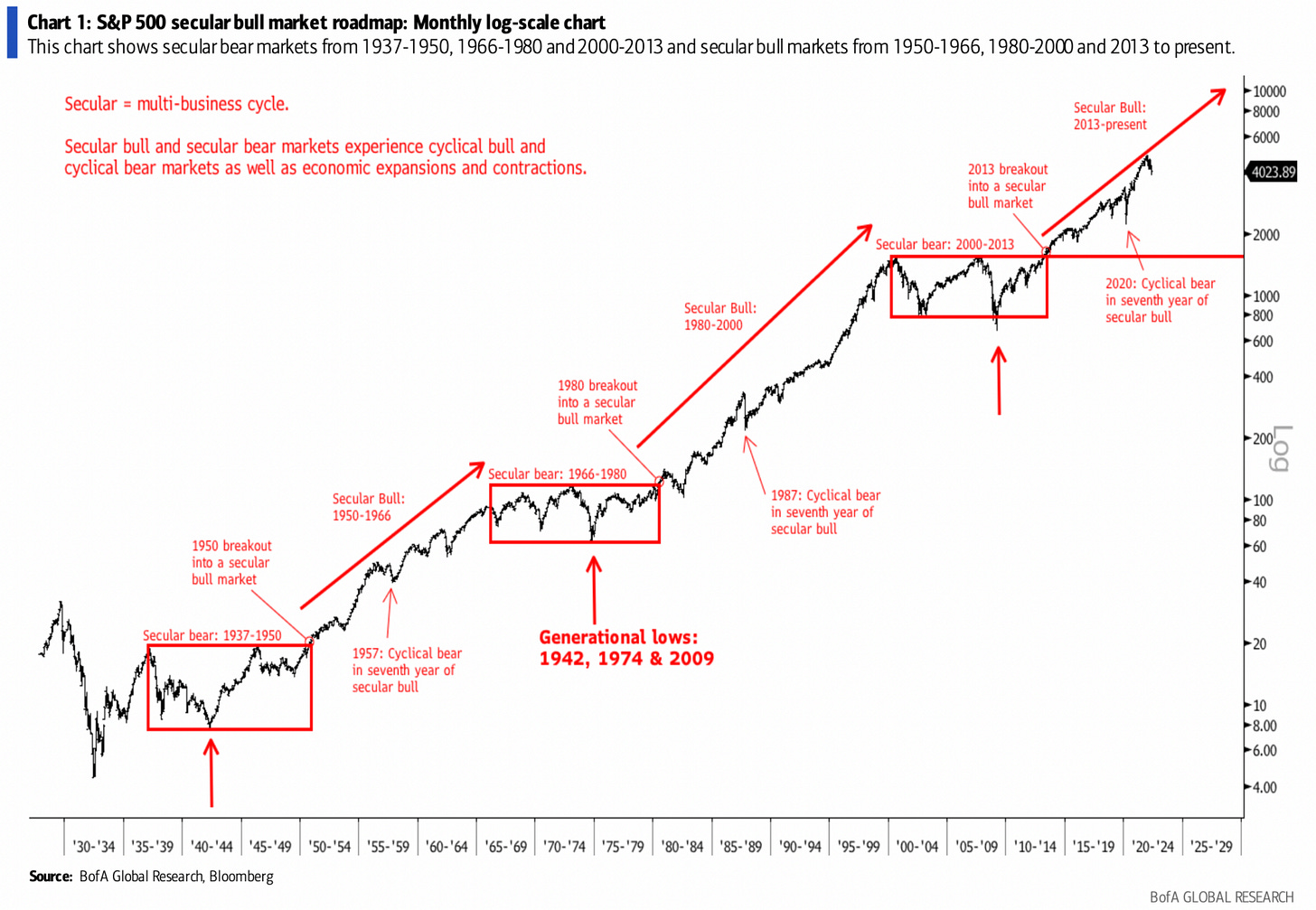

Secular markets vs Cyclical markets

Charts are great at teaching history and are okay at predicting the future. Just keep that in mind. And no one knows what will happen in the future. Keep that in mind too.

There are many technical (charts like the one below) indicators showing this current market dip as a common ‘bump’ in the secular bull market ‘road’.

“The current era is driven by a variety of new technologies ranging from Apps to AI to big data to materials science and non-carbon energy, mRNA, and biotech.”

- Barry Ritholtz

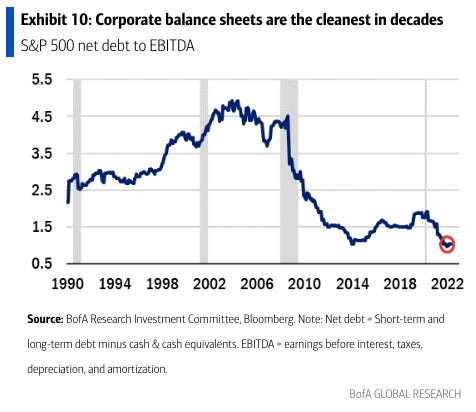

Corporate Balance Sheets

Have never been stronger.

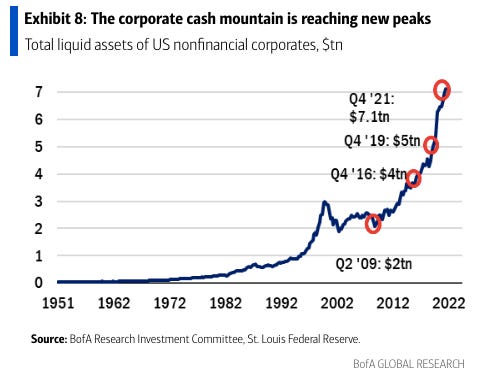

Corporate Cash is also strong.

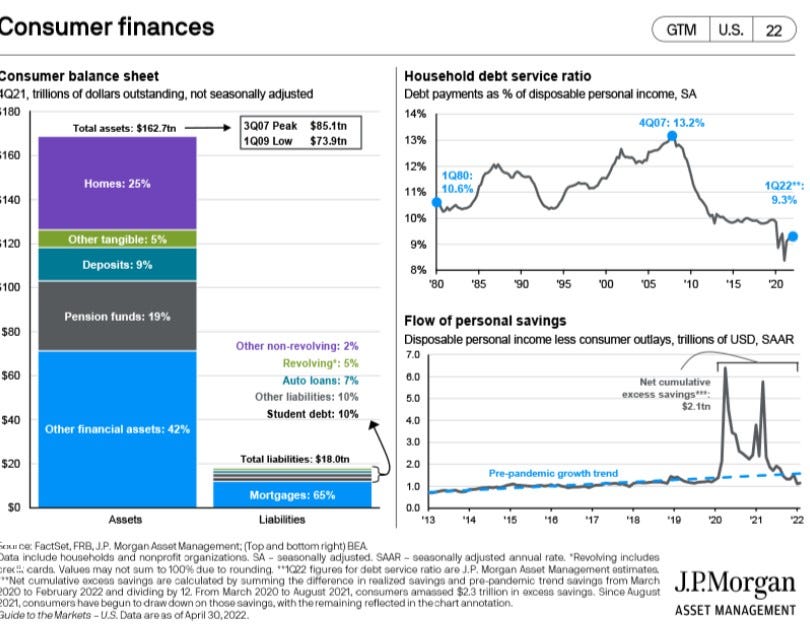

Household balance sheets aren’t too bad either. With excess cashflow, spending and therefore consumption and production will continue. Driving earnings for companies up over the short-term.

If you want to do something, do the right thing. Stick to your plan and know that this is all part of the plan.