Tariffs have a long history dating back centuries. In the early United States, tariffs were the primary source of federal revenue and were crucial in supporting the nation's developing industries.

Notably, the Tariff Act of 1789 was one of the first major legislative acts of the newly formed United States government, designed to raise revenue and protect burgeoning American industries.

Throughout the 19th century, tariffs frequently sparked heated political debates and even contributed to sectional tensions leading up to the Civil War.

Globally, tariffs have been both praised and criticized as instruments of economic policy, trade protectionism, and diplomatic negotiation.

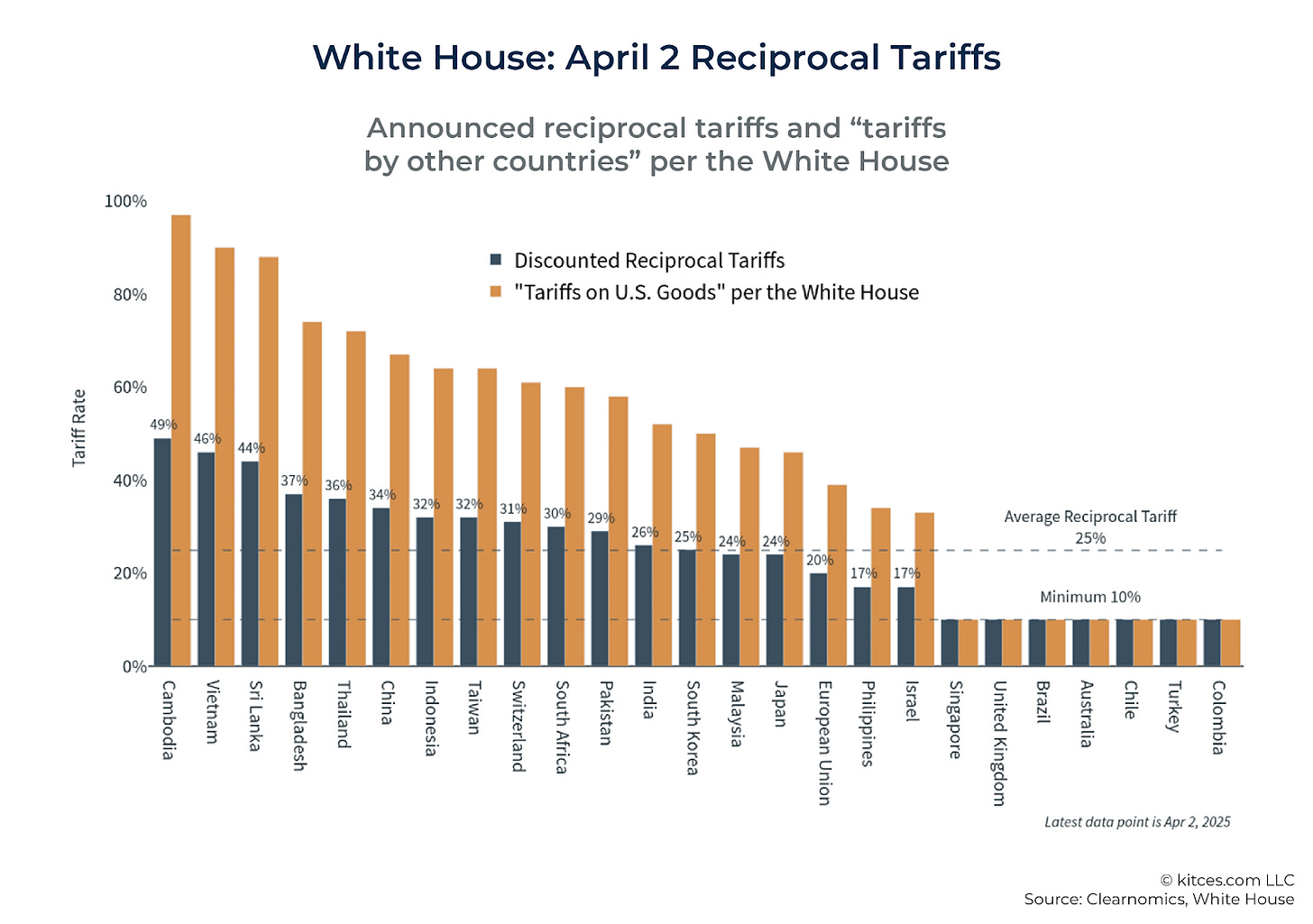

More recently, on April 2, 2025, President Trump announced a comprehensive tariff strategy known as the "Liberation Day" tariffs. This policy includes a universal 10% tariff on all imports, with higher, country-specific tariffs—up to 54% on Chinese goods—aimed at addressing trade imbalances and promoting domestic manufacturing

How Tariffs Work?

When tariffs are introduced, importers must pay additional fees, raising their overall costs. These extra expenses often lead to higher consumer prices (inflation).

The goal behind tariffs is to encourage consumers and businesses to opt for domestically-produced goods, thereby supporting local industries and employment.

Who Benefits from Tariffs?

Tariffs can indeed offer benefits, but typically only to specific groups:

📈 Domestic Industries: Industries directly protected by tariffs—such as steel or agriculture—often experience short-term boosts in profitability and employment.

💰 Government Revenue: Governments collect revenue from tariffs, potentially reinvesting these funds into infrastructure or economic development initiatives.

However, these benefits come with downsides. Consumers face higher prices, businesses relying on imported components experience increased costs, and retaliatory tariffs from other countries can negatively impact exporters and overall economic growth.

A reciprocal tariff is simply a tariff for a country that tariffs US goods. Example Japan has a 50% tariff no US goods so the reciprocal tariff on Japanese goods is 25%.

While these objectives seek to strengthen domestic production and enhance national security, the actual outcomes depend significantly on international negotiations and market responses.

There are 2 main questions left unanswered regarding these tariffs:

Are they real or just a negotiation tactic?

Will they actually work?

The truth is that we don’t really know the answer to either one of these questions. As we have seen over the past few weeks, the hard line on tariffs has moved several times.

And if the tariffs do stick around, the global economy is so complicated and interconnected that the outcome could be any combination of the positive and negative projections we’ve all seen.

I wonder if domestic producers and manufactures can even meet the demand on some of these goods.

As always, I like to focus on those things within our control.

Retirement Strategies in Tariff-Impacted Markets

If retirement is approaching, market volatility driven by tariffs can understandably cause stress. Here's how to navigate this uncertainty effectively:

💪 Strengthen Your Cash Reserves: Having a large cash reserve is sometimes the best medicine for financial anxiety. If you are more worried about the state of the country or economy, stock up on dollars. This will give you the financial agility to dodge many financial obstacles in the future.

🌍 Stay Diversified: Ensure your investment portfolio remains diversified across different asset classes and geographic regions. Diversification is among the strongest protections against uncertainty.

🗂️ Review Your Asset Allocation: Confirm that your investment approach aligns with your retirement timeline. Approaching retirement typically calls for a shift toward more stable, income-producing investments.

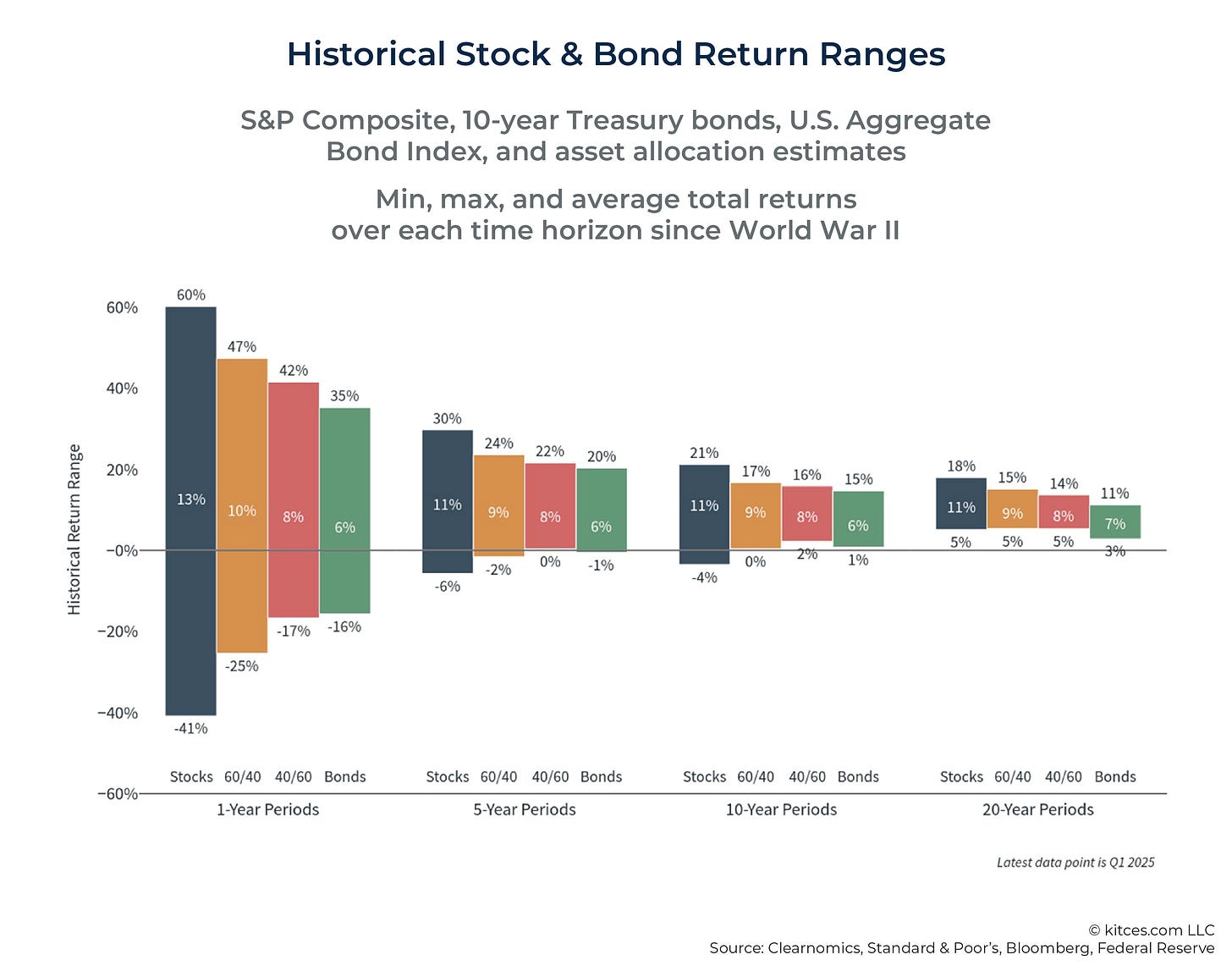

🕒 Maintain a Long-Term Outlook: Historically, markets have adapted to tariffs and other disruptions. Resist making impulsive decisions based on short-term market swings.

📞 Consult Your Financial Advisor: It's crucial now to review your retirement strategy, perform stress-tests on your portfolio, and ensure your investment approach can withstand volatility.

Keep an eye on the far right section of the graph. Over the last 20 years, despite all the turmoil, the markets have ‘held it together’ and performed great. That is where we should look rather than the nightly news. It will all be ok.

Tariffs inevitably create economic ripples, but careful financial planning can ensure these disturbances don't disrupt your retirement objectives. Stay informed, stay strategic, and keep your long-term goals clearly in focus.