TLDR; my headline is click bait. But if your curiosity brought you this far its because I’m right, so reading this article will 100% help.

Investors today are confronted with a constant stream of information that can tempt them into frequent trading or lead them to avoid the markets altogether in times of uncertainty. Yet history shows that staying invested in public markets for the long run has been one of the most reliable ways to build wealth over time.

From the longevity and magnitude of bull markets to the stark consequences of missing just a handful of the market’s best days, the evidence strongly supports a consistent, long-term investment strategy.

The Benefits of Long-Term Investing

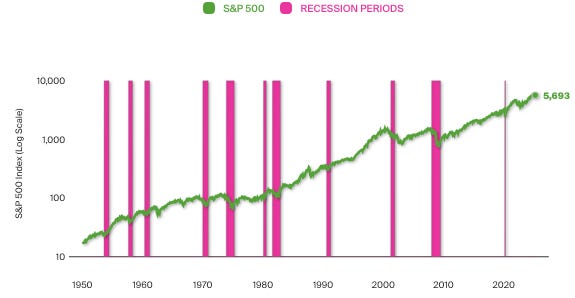

One of the most frequently cited statistics about U.S. equities is their remarkable long-term growth rate. Depending on the exact timeframe measured, the S&P 500 has delivered an average annual total return (including dividends) of around 9–10% since the late 1920s.

While short-term volatility can be unsettling, these long-horizon returns underscore the power of long-term compounding:

From 1926 to 2022, the S&P 500 averaged roughly 10% annualized returns, despite enduring multiple world wars, recessions, oil crises, and the Global Financial Crisis of 2007–2009.

Even after notable drawdowns—such as the 50%+ plunge during the 2008–2009 period—investors who stayed invested typically recouped losses and then achieved new highs in the ensuing rebounds.

Over long stretches, consistent market participation tends to outpace attempts to “time” the market or hop between various investment vehicles.

Even professional investors, armed with research and trading algorithms, often struggle to predict short-term market movements accurately. The real engine of wealth generation is letting compounding do its work over years and decades.

Bull and Bear Markets: Durations and Frequencies

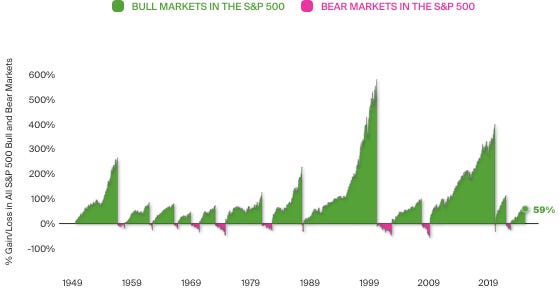

Investors often fear bear markets—those periods where prices drop by 20% or more from recent highs. While these declines can be sharp and painful, history shows that bull markets have been more frequent and have lasted longer:

Bear Markets (Pink section below)

Since 1926, the S&P 500 has experienced roughly 27 bear markets.

On average, bear markets have lasted about 1 to 1.5 years, with an average cumulative decline in the range of 35% to 40%.

Despite their severity, they are relatively short-lived compared to bull markets.

Bull Markets (White sections below)

In the same period, there have been about 26 bull markets.

These have lasted, on average, around 5 to 6 years, with total gains of roughly 150–200%.

Some bull markets have been shorter yet robust (for example, the rapid rebound following the 2020 COVID-19 crash), while others stretched out over a decade (as in much of the 1990s).

The fact that bull markets historically have been both longer in duration and more powerful in magnitude means that staying invested through downturns has usually been rewarded—provided you have a long enough time horizon and sufficient diversification.

Its very confusing to me how anyone could be pessimistic about investing after these charts.

The Cost of Missing the Best Days—And When They Occur

One of the most compelling arguments for continuous, long-term market participation is how quickly markets can swing upward—often in a matter of days or weeks. A well-known study on S&P 500 performance highlights the dramatic effect of missing just a handful of the best trading days:

Over a 20- to 30-year period, if you missed the market’s best 50 days, your total return would plummet compared to if you had stayed fully invested. In some analyses covering multiple decades, missing those 50 days could mean losing over half of your would-be returns.

Counterintuitively, a significant portion of these “best days” cluster around the worst market declines.

For instance, many of the top single-day gains over the last three decades occurred in the wake of major sell-offs (e.g., late 2008, early 2009, and the rapid bounce-back days in March and April 2020). Sometimes the day after a big drop.

Here is the main takeaway:

If you want the best trading days, you have to accept the worst days. Its a package deal.

Putting It All Together

Long-Term Compounding

By staying invested in public markets, you tap into the power of compounding. Even moderate average annual returns, when allowed to build over decades, can produce substantial wealth.Bull Markets Outlast Bear Markets

Historically, bull markets have been longer and stronger than bear markets. Short downturns, while painful, have eventually given way to prolonged periods of growth.Don’t Miss the Best Days

Missing the best 50 trading days over several decades can seriously erode your total returns. Critically, those best days often happen shortly after market lows, when many investors are on the sidelines.Stay Disciplined

The market’s short-term volatility can be unsettling, but discipline and a focus on long-term goals generally trump reactionary market-timing tactics.

Final Thoughts

Market fluctuations are an inevitable part of investing. Over the course of history, the U.S. equity market has repeatedly overcome bear markets and recessions, rewarding patient investors with robust returns.

While no one can guarantee future performance, the lessons embedded in nearly a century of stock market data are hard to ignore: focus on a sound plan, stay disciplined during market stress, and remain invested to capture the best days that drive so much of the market’s total return.